Abstract

The objective of this project is to briefly explain employee stock options, their functionalities, tax consequences and value these options using Binomial Lattice Model. Employee stock option plans are contracts between a company and its employees that give them the right to buy a specific number of the firm's shares at a fixed price within a certain period of time. Firms generally do not disclose the details of employee stock options to the public such as exercise behavior, age, income level etc. Due to the lack of necessary information, this project only explores the exercise behavior of key employees whose data are available to the public. We want to be able to compare our results with actual financial statement components to seek accuracy and on this purpose Federal Express Inc. will be our case of study.

Researchers:

Research Group (2014 Fall):

Bilgin Demir, Master in Financial Engineering, Graduated in Jan 2015

Advisor:

Dr. Ionut Florescu

Research Topics:

Employee Stock Options, Binomial Lattice Model, Key Employees

Main Results:

Firms mostly value options using Black Scholes model and all existing option-pricing models use the assumptions that are generally not designed for employee stock options.

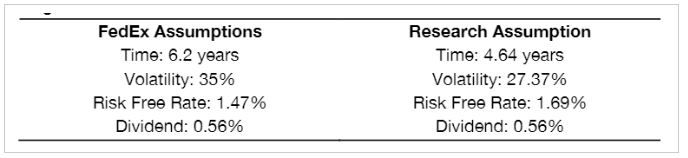

As this project concluded we observe that key employees generally use cash purchase or cashless sell as their exercise transaction type. September as a month is with no exercise history as a quite period. We also find that the average expected life of the options as 4.64 years compared to the 6.2 assumption disclosed by the company.

Conclusions:

Our main goal is to value the employee stock options to compare our results with firms' disclosure to Securities Exchange Commission. Even though the company assumptions and our inputs are different, we observe that the option values are very similar. The reasons behind this might be that the company includes forfeiture rate into the option calculation that offsets and of course reduce the average expected life of the option. But our results being close to the company result doesn't necessary prove that observing only key employees' transaction behaviors are sufficient to calculate the fair market value of the employee stock options.