Abstract

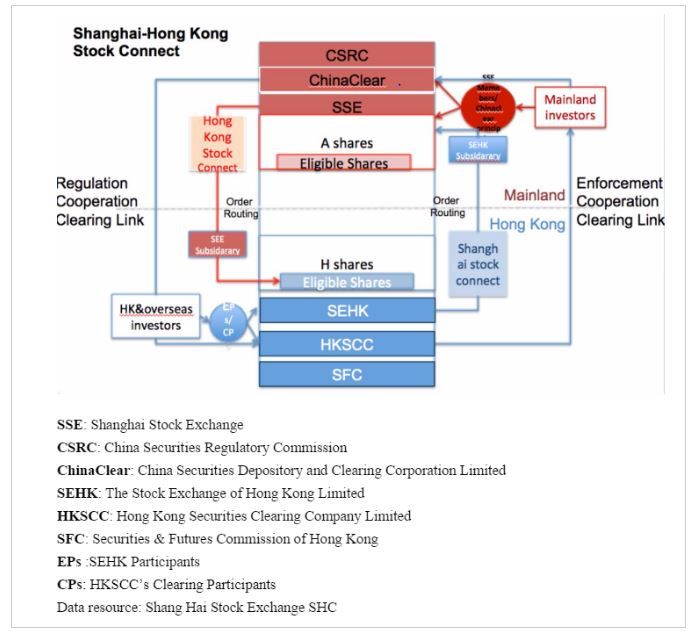

The aim of this project is to explore arbitrage possibilities in trading frequency difference and correlation between stocks from the same companies and traded in both mainland and HK markets. Under regulations of the Chinese government, there are many obstacles for high frequency trading in stocks and futures in China. There is no Level 2 data, and Chinese stocks settle at T+1 while HK stocks settle at T+0. But with the establishment of Shanghai-Hongkong Stock Connect, arbitrage opportunities may exist.

Researchers:

Research Group (2014 Fall):

Jian Zhang, Master in Financial Engineering, Graduated in Jan 2015

Mengting Xiong, Master in Financial Engineering, Graduated in Jan 2015

Yang Chu, Master in Financial Engineering, Graduated in Jan 2015

Advisor:

Dr. Ionut Florescu

Main Results:

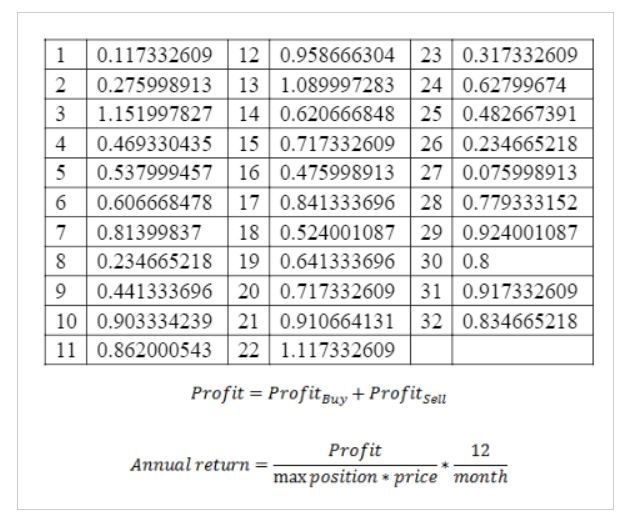

A pair trading strategy has been established to test on the data set. The combination of a long position and a short position is a pair of trading. Our model generates 62 trades through this time period. By simply trading the futures, the annual return of this portfolio is nearly 7%. The trading profits are shown as below:

If we choose the confidence interval to be 80% instead of 90%, the profit will increase from 7% to 12%. However, trading more frequently will also increase the risk of loss.

Conclusions:

It has become clear that making money in Chinese futures market is possible. Based on accurate historical modeling and the proper explanations of results, traders can identify truly correlated stocks and futures, looking for trading opportunities, and use model to control trades, hence making profit. Investment decisions should be considered carefully, taking the risks into consideration.

Research Topics:

Chinese Market, Hayashi-Yoshida Estimator, Futures, Shanghai-Hongkong Stock Connect