Abstract

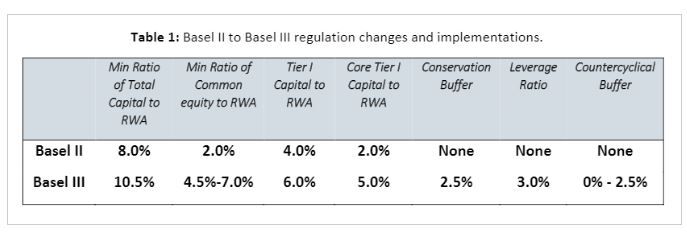

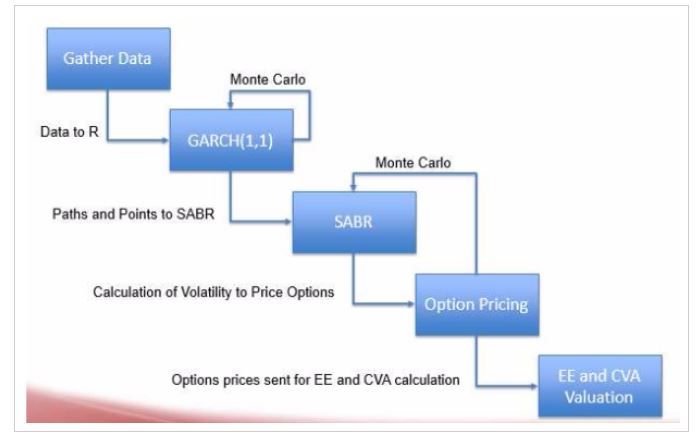

The purpose of this study is to evaluate Basel III regulations and call options between two counter parties on SPY using large-scale Monte Carlo methods in accordance with a GARCH(1, 1) and SABR model. We will calculate Expected Exposure (EE) and Credit Valuation Adjustment (CVA) as the options approach their maturity date. The Basel III regulations are a comprehensive set of reforms that was brought on due to the financial crisis of 2008. It was created to strengthen the regulation, supervision and risk management within the banking industry. One of the primary vehicles for the enhanced risk regulation is a framework on bank capital adequacy, stress testing and market liquidity.

Research Topics:

Basel III regulation, Credit Valuation Adjustment, Expected Exposure

Researchers:

Research Group (2014 Fall):

Brian Larkin, Master in Financial Engineering, Graduated in Jan 2015

Vatsal Parekh, Master in Financial Engineering, Graduated in Jan 2015

Ronak Shah, Master in Financial Engineering, Graduated in Jan 2015

Advisor:

Dr. Rupak Chatterjee

Main Results:

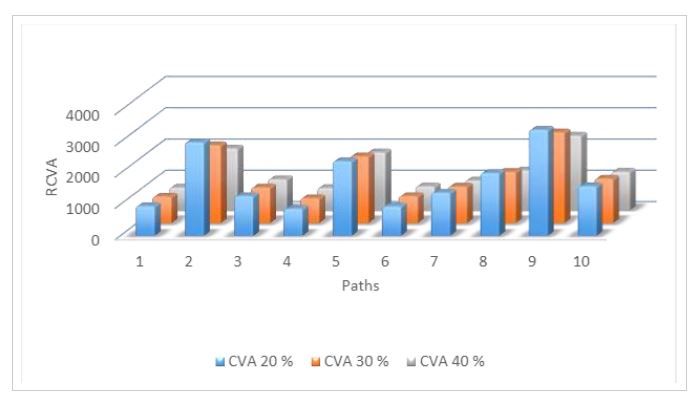

We need to determine a survival curve that can be used in the calculations of CVA. Then we also conduct a SABR calibration. From there we get an Expected Exposure Path:

And CVA as well:

Conclusions:

Utilizing a large-scale Monte Carlo simulation in conjunction with the SABR and GARCH models allow us to find the potential CVA at all-time points up to the expiration date of a two year option on SPY. The model is successful, but can be improved in future applications by making the interest rate and hazard rate stochastic. The calculation of these numbers is critical to prevent systematic default. Basel III and its calculations force banks to build up cash reserves and have buffers that will aid them in times of stress. The strict regulations will also force financial institutions to use clearing houses, which would decrease the chance of systematic defaults, because the clearing house will essentially act as buyer to the seller and the seller to the buyer. If one counter party defaults, the clearing house will then step in and take over the positions.