In June 2014, The Economist, reported that,

The total student loan debt in the market is over $1.2$ trillion dollars.

These loans are either categorized as federal or private loans. Federal loans are given out by the United States government and in 2014 totaled $98.1 billion of all student loans. Private loans on the other hand are given out by financial institutions, and tend to charge a higher rate of interest, thereby increasing the rate of default. Defaulting on student loans can have a lasting impact on the economy. The project will center around the macroeconomic impact on the economy and markets of student loan default and aim to give a clearer picture of the influences of the potential systemic risks around it. Using any available Federal data on student loans as well as comparable research, our project will additionally try to classify any factors attributable to student loan default. The motivation behind our thesis is to introduce a more quantitative aspect to looking at Student Loans and their macroeconomic effects, when compared to more qualitative papers already published.

Research Topics:

Student Loan

Applications:

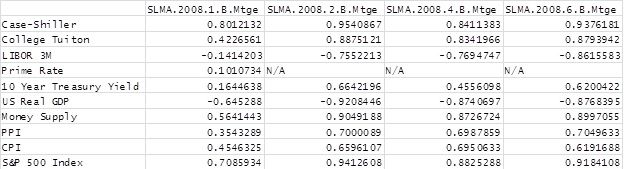

The methodology we adopted was to locate tranches within our database and measure the correlation and causation towards the different External market Factors such as Unemployment, Money Supply, Consumer Price Index etc.

We used the long term rating assigned by Moody’s and Fitch to isolate several tranches that comprised the most credit risk as judged by the respective credit agencies. To further narrow down the list, we used Delinquency Loan ratios as well as the distribution of loans in default. The respective tranches are displayed below:

- SLMA 2008-1 B

- SLMA 2008-2 B

- SLMA 2008-4 B

- SLMA 2008-6 B

Main Results:

One observation to take note of is the concentration of credit risky tranches in the year of 2008.This can be explained due to the higher concentration of interest rates in the 6% and higher range when corroborating with our ABS issuance breakdown data.

The outlying Market Factor is 3M Libor that unanimously causes fluctuations in the Tranche pricing. Though, this is expected since the tranches have coupon payments with the Libor rate.

One alarming observation is the significant cause of Tranches on the Case-Shiller Index. If such credit tranches were to default, they might affect the housing market, that initially led to the 2008 collapse. The high correlations between the Case-Shiller Index and the 4 Tranches further paints a picture of the effect on the housing market.

Conclusions:

We were able to find and map conclusive areas of the economy where such ABS defaults might affect that include the housing sector, Libor rates etc and looked at the loans from a geographical point of view as well. With a data set this large, on an ever-increasing market, there are many more avenues for research, both building on the work we have done, and diverging into different paths. It is our belief that the following topics would allow this research to grow to a new level. The possibility of looking into private loans instead of the public Sallie Mae loans is one topic to be explored. Unfortunately, because of the very nature of private loans, there is not an easy way to access data on them to continue this line of research. This study focuses heavily on one issuance, but there are different issuance that can be studied, and in a more quantitative approach, determining which issuance are riskier for investors based on different factors and attributes. We hope to be able to focus on this as one of our main courses of action moving forward. Another aspect that we want to work on is evaluating how this asset-backed security is priced, and develop new pricing methods based on the influx of quantitative data and analysis that is now possible. While there is only so much that is feasible for a researcher to accomplish, we hope this initial study has fueled a market for continuing research into the student loan market and its securitization.