Research Project:

The analysis of occurrence of rare events along with their significant negative economic impacts has been a challenging topic in recent years. Both academics and practitioners have approached this problem from different perspectives. Rare events are discrete events that happen infrequently and therefore there is no traditional statistical framework that allows the real-time detection and analysis of them. This research framework is constructed around the development of new techniques that extracts information out of massive data sets and spans the areas of data science, machine learning and financial model analysis. In particular, my research investigates methods to reduce the complexity of the analysis, map large amounts of data and construct a unique early-warning rare events detection system.

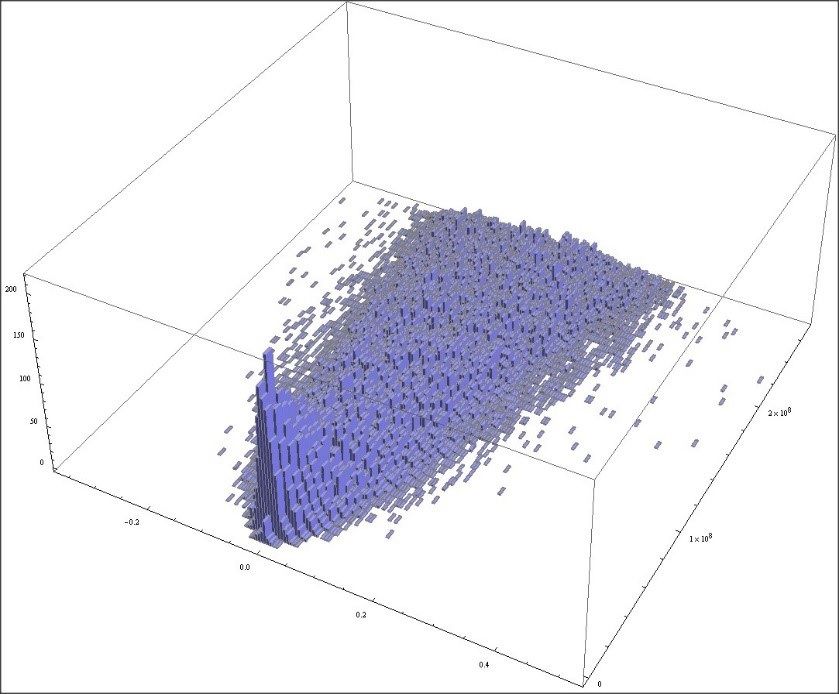

The data in this research is a high frequency trade level data for a most traded symbol such as JPM over ten days. The observations at this tick-by-tick detailed data-set are represented by trades. Each of these observations consist of Price $(P)$, Volume $(V)$ and Time $(T)$. According to the objective of this work, which is defined as the return and time movements corresponding to the volume traded, three dimensional distribution of $P((r, \Sigma{V}, \Delta{T}) \vert \Sigma{V} < V_0)$ have to be constructed. Many researchers only consider the consecutive time intervals in their analysis. However, we believe rare events occur not only on consecutive time frames but also over several trade intervals. This reason will change the type of the distribution we need to construct. Since we focus on high frequency trading data sets, studying the impact of duration between all available trades conditional on volume is difficult. In order to accelerate this step, we apply CUDA programming on our computation.

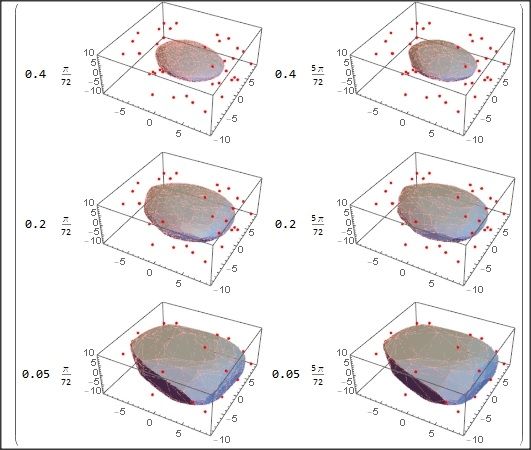

After Computing distribution, we apply zonoid trimming algorithm to detect rare events.This algorithm is widely used in many fields. However, none of the available literature considered this statistical concept in financial fields. In this paper we apply zonoid depth functions on our $3-$dimensional distribution. The goal is to construct convex bodies that identify financial rare events.

The result of $\alpha$-zonoid trimmed region is a convex polytope. The position of each point with respect to the set of points can be studied as a criteria to detect rare events. Each point that lies outside of the obtained convex hull is categorized as rare event. There are several algorithms proposed in literature which evaluate the position of data points.

Although this polytope construction provides us with the set of extreme points in an efficient way, the rotation is a high computational problem. Symmetric Multi-Processing mode of HPC environment enables us to obtain these $\alpha$-zonoid trimmed regions at the same time on multiple cores. Combination of MPI between GPU nodes and OpenMP / threads within a single node will address this part of high dimensional problem of our algorithm.

Research Topics:

- Compute a 3-dimensional distribution based on High Frequency Trading datasets

- Applying Zonoid Depth Functions on multidimensional distribution

- Detection of rare events based on the points located outside of convex bodies

- Applying a parallel computing algorithm (Cuda) in order to accelerate the computation

Researchers:

- Parisa Golbayani, Ph.D. candidate in Financial Engineering, pgolbaya@stevens.edu

- Dr. Dragos Bozdog, Teaching Associate Professor, Deputy Director of the Hanlon Financial Systems Lab, dragos.bozdog@stevens.edu

Publications:

- "A Study of Rare Events in High-Frequency Financial Data", D. Bozdog, Ph.D. Dissertation, Stevens Institute of Technology, 2014.

- "Rare Events Analysis for High-Frequency Equity Data", D. Bozdog, I. Florescu, K. Khashanah, and J. Wang, Proceedings of the 10th International Workshop on Rare Event Simulation, RESIM 2014, Amsterdam. (link)

Awards and Grants:

- "2016 FINCAD WOMEN IN FINANCE SCHOLARSHIP" , Parisa Golbayani, Financial Engineering Division, Stevens institute of Technology (link)

- Nvidia grant to develop GPU compute infrastructure based on Nvidia Tesla cards, and recognition of Stevens Institute as a Research Center in CUDA, PI, 8 GPU cards donated, market value at $28,000

Sponsors:

SciChart: SciChart WPF Charting software provides the environment for development of GUI for the Rare Events Project