We study here a novel algorithmic and theoretical solution to several important problems in quantitative finance. The main theoretical framework involves the theory of linear and nonlinear filtering. We consider here several problems: volatility estimation in stochastic dynamical models, hedge fund replication using liquid assets, and filtering problems that arise in Markovian factor models for the term structures of interest rates and for credit risk models. In order to show the advantages of our approach, numerical studies with market data are developed and analyzed. The method will turn out to be highly efficient and elegant, and thus suited for real time applications.

Research Topics:

The main idea is to formulate the problem of estimating the stochastic volatility in terms of a nonlinear filtering problem, and then use the numerical results available in the literature and market data to estimate and compare the obtained volatility. Also, the asset replication problem can be dealt with by using the nonlinear filtering approach, in order to estimate the investment strategy, i.e. the factor wights, using nonlinear models for the underlying asset price. Another interesting problem is to replicate leveraged ETF (LEFT), and how to invest in options on ETF in order to replicate a specific hedge fund.

To tackle the nonlinear filtering problem in Quantitative Finance, we propose here a novel approach, not investigated in the literature, based on the ideas first introduced and developed by Frost and Kailath [1], and in somewhat definitive form by [2]; see also the excellent review paper of Mitter [3]. The main idea is to obtain a recursive equation for the conditional probability density of the hidden variable, which can be solved numerically by employing some transformations: with the idea of Duncan, Morris, and Zakai (DMZ), we can reduce the nonlinear stochastic partial differential equation to a linear one, which in turn can be solved numerically using the Yau-Yau method [4], see also [5] for some recent developments. It was further shown that the DMZ equation can be further written as a Schrodinger equation, see [6] for an analogy between nonlinear filtering and quantum mechanics, for which efficient algorithms were developed. Moreover, under some specific conditions, finite–dimensional filters (or exact nonlinear filters) are known to exist, for example the Daum filter [7, 8], or the Benes filter [9].

Our final aim is to develop elegant explicit solutions and numerically sound and efficient algorithms for the aforementioned problems, by using the ideas presented above. The results will be compared with other existing techniques, e.g., particle filtering.

Researchers:

- Sebastian Tudor, PhD Student in Financial Engineering, studor@stevens.edu

- Dr. Igor Tydniouk, Industry Professor in Department of Financial Engineering, Igor.Tydniouk@stevens.edu

- Dr. Rupak Chatterjee, Industry Professor in Department of Financial Engineering, Rupak.Chatterjee@stevens.edu

Publications:

Nonlinear Filtering methods in Quantitative Finance, working paper

Applications:

The Asset Replication Problem

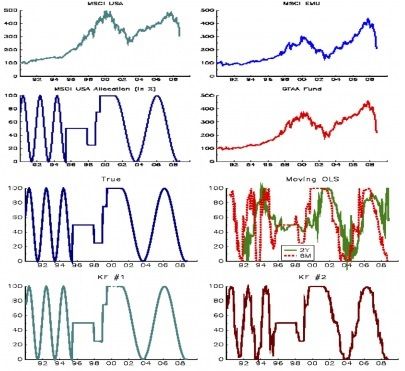

In general, factor replication deals with replicating (or tracking) the returns of a hedge fund strategy with the returns of several other assets. The returns of the target asset $$r_{obs}(t)$$ and the factors $$r_i(t)$$ can be observed. To track the target asset, one must come up with time-varying portfolio weights $$x_i(t)$$, such that the tracking error is minimized. The model is:

$$r_{obs}(t) = \sum_i x_i(t) r_i(t) + \varepsilon(t)$$

$$\frac{d}{dt}x_i(t) = x_i(t)+w(t)$$

A continuous-time Kalman filter can be applied. Further extensions involve considering the future state to be a linear combination of present states, and taking into account a control variable, e.g. the value of an index.

Our hypothesis for this linear problem is that by adding the matrices and controls, we have more exibility, and as a consequence we can obtain better replicating results, even for the cases when the previous lter didn't work. For the filter above, one main problem has to be addressed: how to estimate the parameters of the new matrices? The answer is rather straightforward: we can augment the number of states by the unknown parameters and rewrite the equations. The model will become an adaptive model, since its parameters will change with time.

To address these problems in a complete theoretical framework, some ideas might be used from Electrical Engineering and Control Theory. We give below one simple exemple showing that even a standard Kalman filter can outperform the Ordinary Least Square (OLS) method, which is broadly used in industry.

References

- P. A. Frost and T. Kailath, “An innovations approach to least-squares estimation– Part III: Nonlinear estimation in white Gaussian noise,” Automatic Control, IEEE Transactions on, vol. 16, no. 3, pp. 217–226, 1971.

- M. Fujisaki, G. Kallianpur, and H. Kunita, “Stochastic differential equations for the non linear filtering problem,” 1972.

- S. K. Mitter, “Filtering and stochastic control: a historical perspective,” Control Systems, IEEE, vol. 16, no. 3, pp. 67–76, 1996.

- J. Chen, S. S.-T. Yau, and C.-W. Leung, “Finite-dimensional filters with nonlinear drift IV: Classification of finite-dimensional estimation algebras of maximal rank with state-space dimension 3,” SIAM journal on control and optimization, vol. 34, no. 1, pp. 179–198, 1996.

- Z. Liu, F. Dong, and L. Ding, “Numerical Results of Nonlinear Filtering Problem from Yau-Yau Method,” Journal of Computers, vol. 7, no. 4, pp. 971–976, 2012.

- S. K. Mitter, “On the analogy between mathematical problems of non-linear filtering and quantum physics.,” tech. rep., DTIC Document, 1980.

- F. E. Daum, “Exact finite-dimensional nonlinear filters,” Automatic Control, IEEE Transactions on, vol. 31, no. 7, pp. 616–622, 1986.

- F. E. Daum, “New nonlinear filters and exact solutions of the fokker-planck equa- tion,” in American Control Conference, 1986, pp. 884–888, 1986.\

- V. Benes, “Exact finite-dimensional filters for certain diffusions with nonlinear drift,” Stochastics: An International Journal of Probability and Stochastic Processes, vol. 5, no. 1-2, pp. 65–92, 1981.