Researchers:

Lantian Jia

Wenbo Yu

Faculty Advisors:

Ionut Florescu

Cristian Homescu

Abstract:

The article discusses the benefits of asset diversification in reducing investment risks and increasing returns, and also highlights the challenges of such as high asset correlation and difficulty in constructing a covariance matrix if too many assets are considered. In this article Hierarchical Clustering Method was used to construct an asset allocation model with more risk diversification capabilities. This article compared eight hierarchical clustering methods, and DBHT was found to have better stratification effect in the in-sample test. Secondly, HERC model was built based on DBHT hierarchical clustering, and assigned weights. In addition, the S&P 500 index was used as a benchmark to conduct a backtesting of the asset allocation model. Finally, further study analyzed the performance of the investment portfolio in three different cycles before and after the financial crisis.

Results:

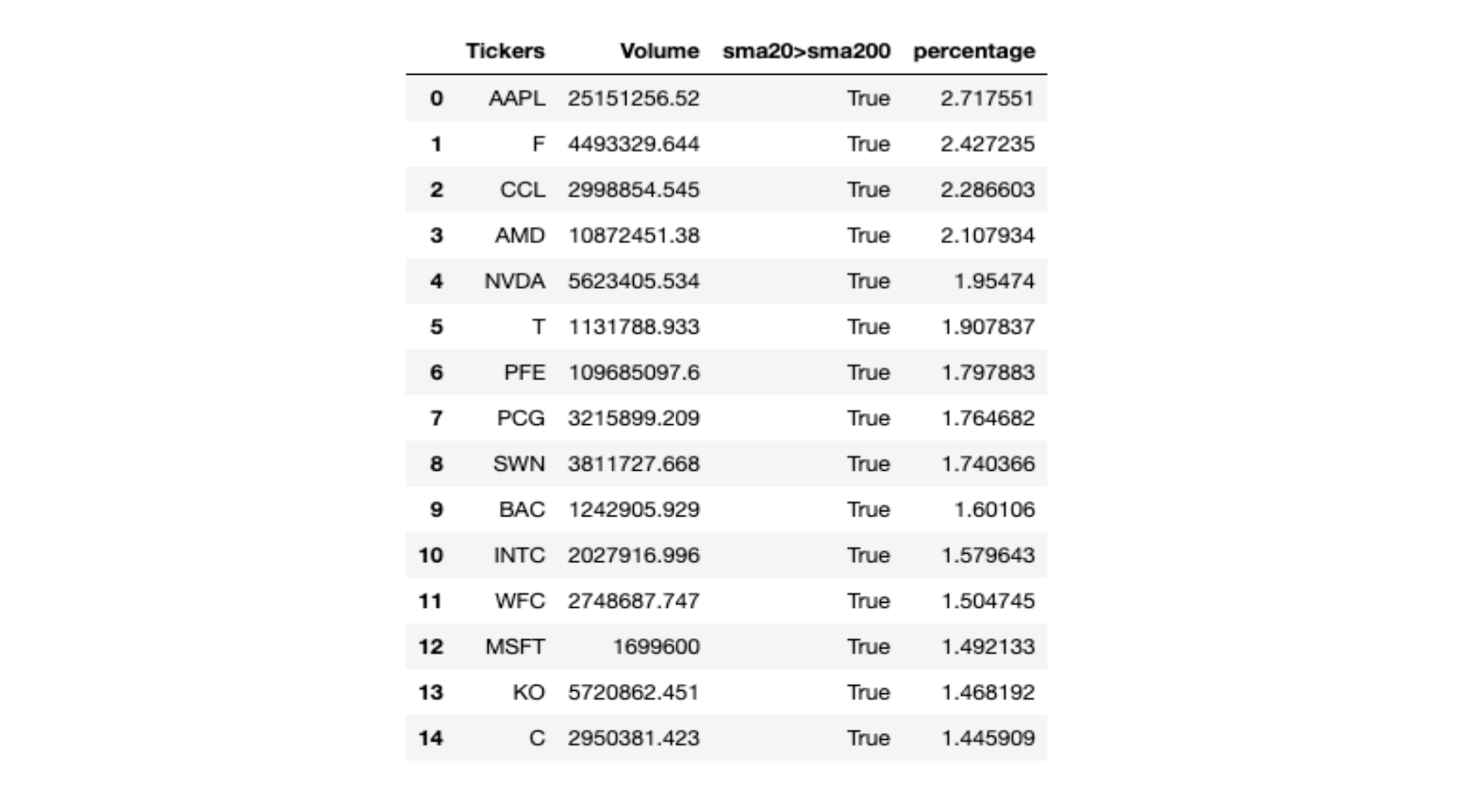

This article used pooled data of 2002 to 2020 tickers. 5,180 stocks out of 8,110 without missing value were filtered to select 20-day simple moving average higher than 200-day simple moving average. So, top 15 tickers were selected as shown below:

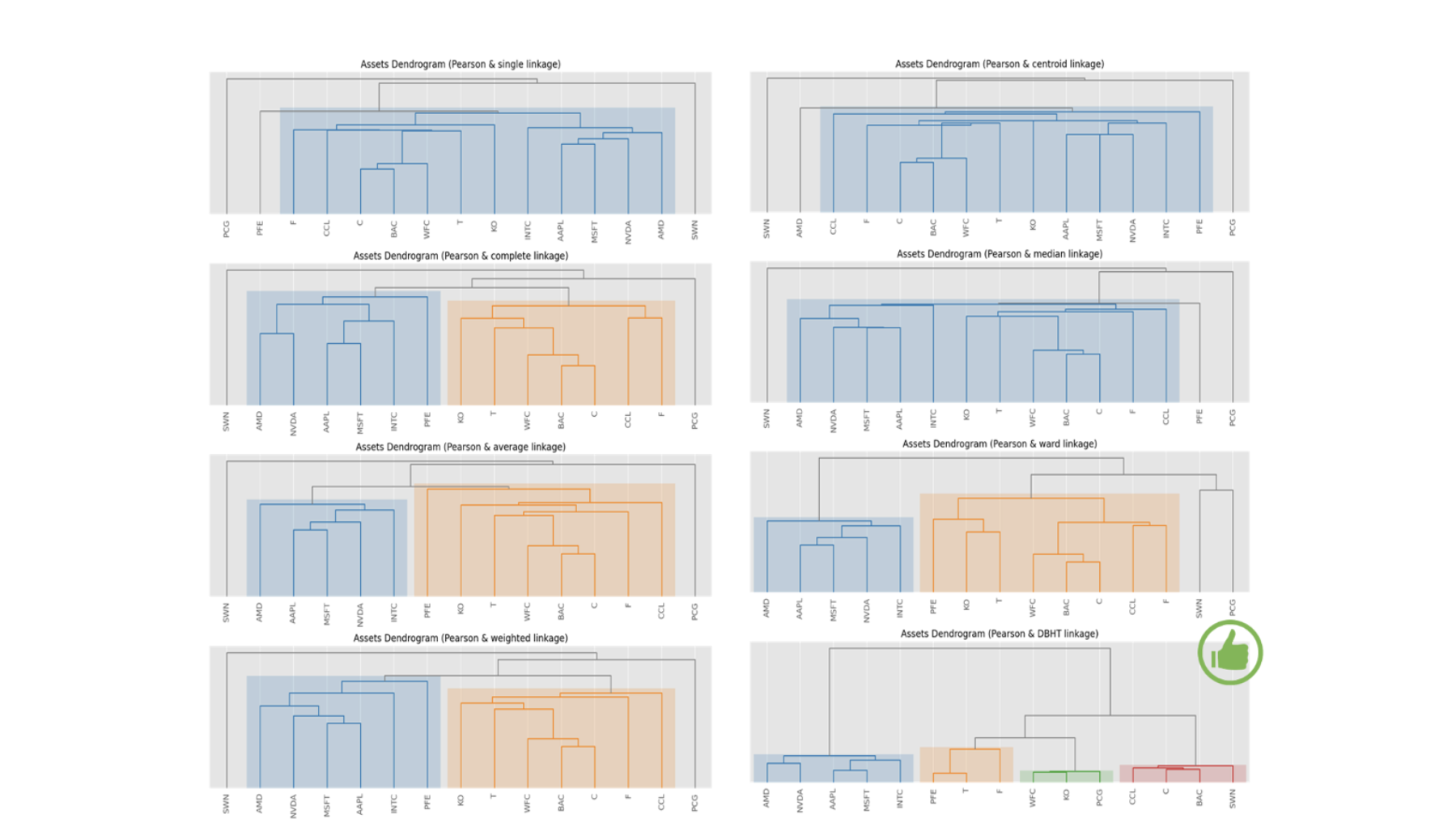

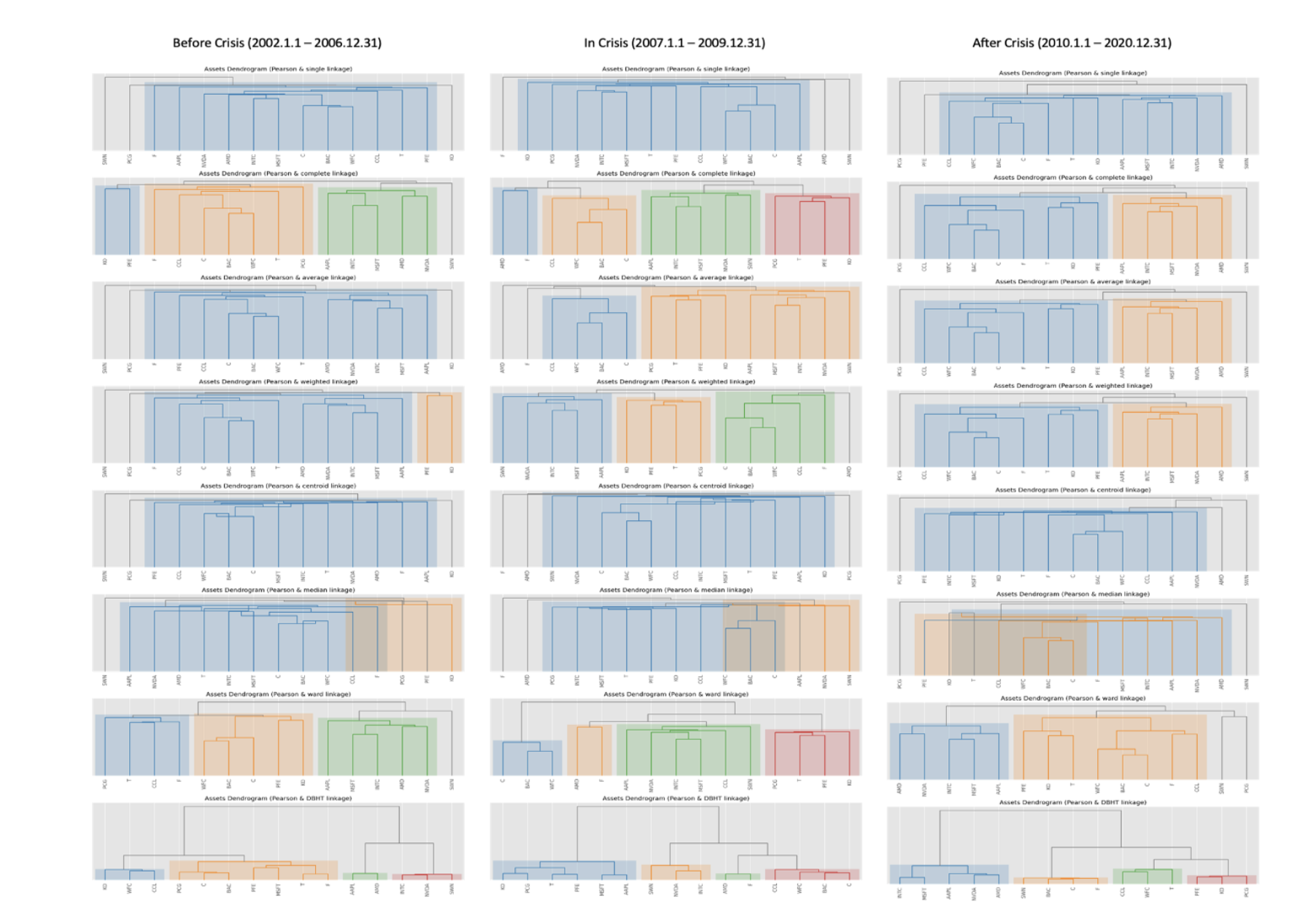

The study tested eight hierarchical methods on a selection of 15 tickers and found that only the DBHT method produced significant clustering, while the other seven methods did not yield useful results. The commonly used Ward method usually performs well, but in this case, DBHT outperformed it, indicating that when the Ward method fails, DBHT can still produce significant clustering. The hierarchical structure is depicted in the Figure below:

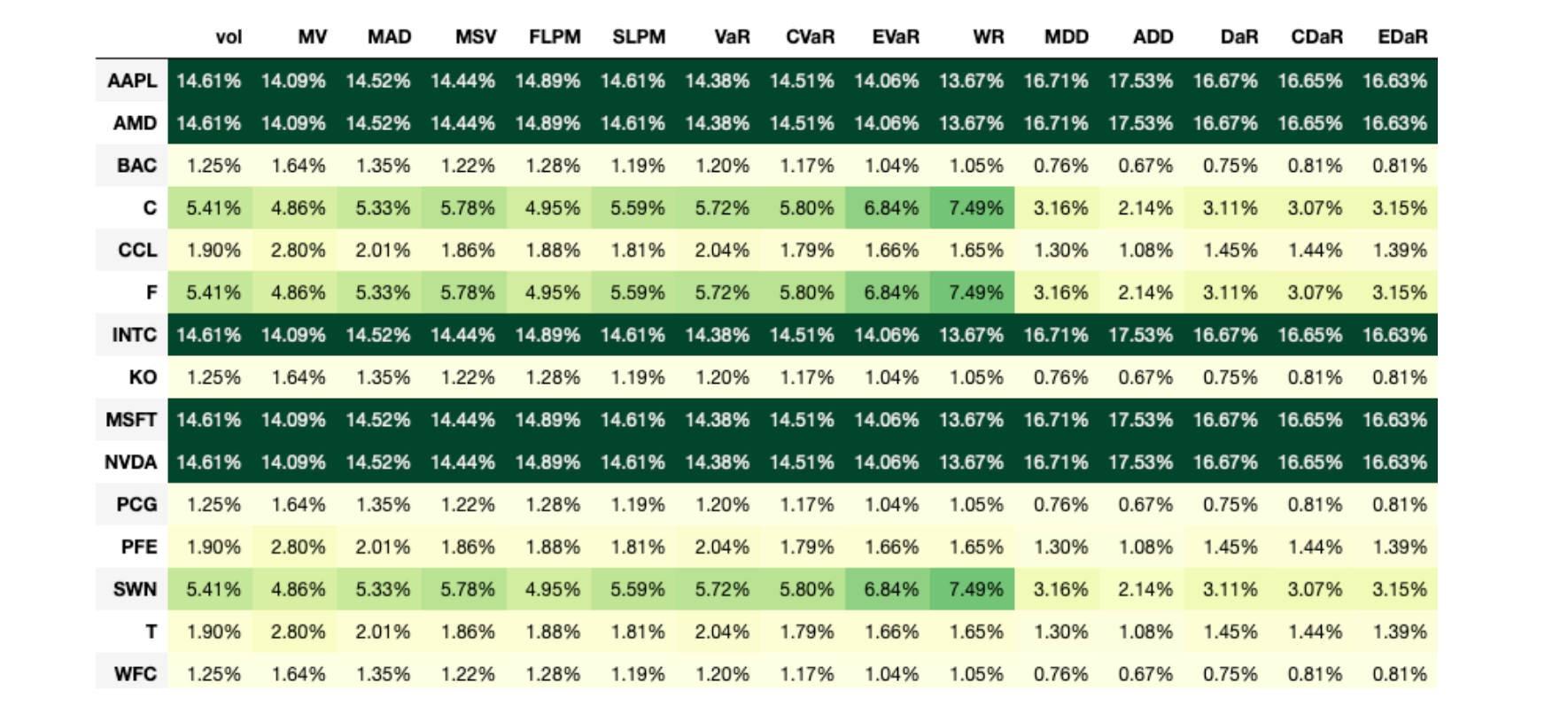

As a next step, the article adopted DBHT into HERC model and it was found that most correlation coefficients were near zero. Low correlation can guarantee more accurate portfolio results. Below weights were generated by the HERC model:

The study employed 12 risk measures to assess the contribution of each stock to the portfolio and found that certain stocks had a greater impact on the portfolio than others, suggesting that it was not sufficiently diversified. Figure below illustrates this by showing that stocks with higher weights in the portfolio also had higher risk measure results. However, some stocks with relatively higher risk measures such as tickers C, F and SWN had lower weights in the portfolio.

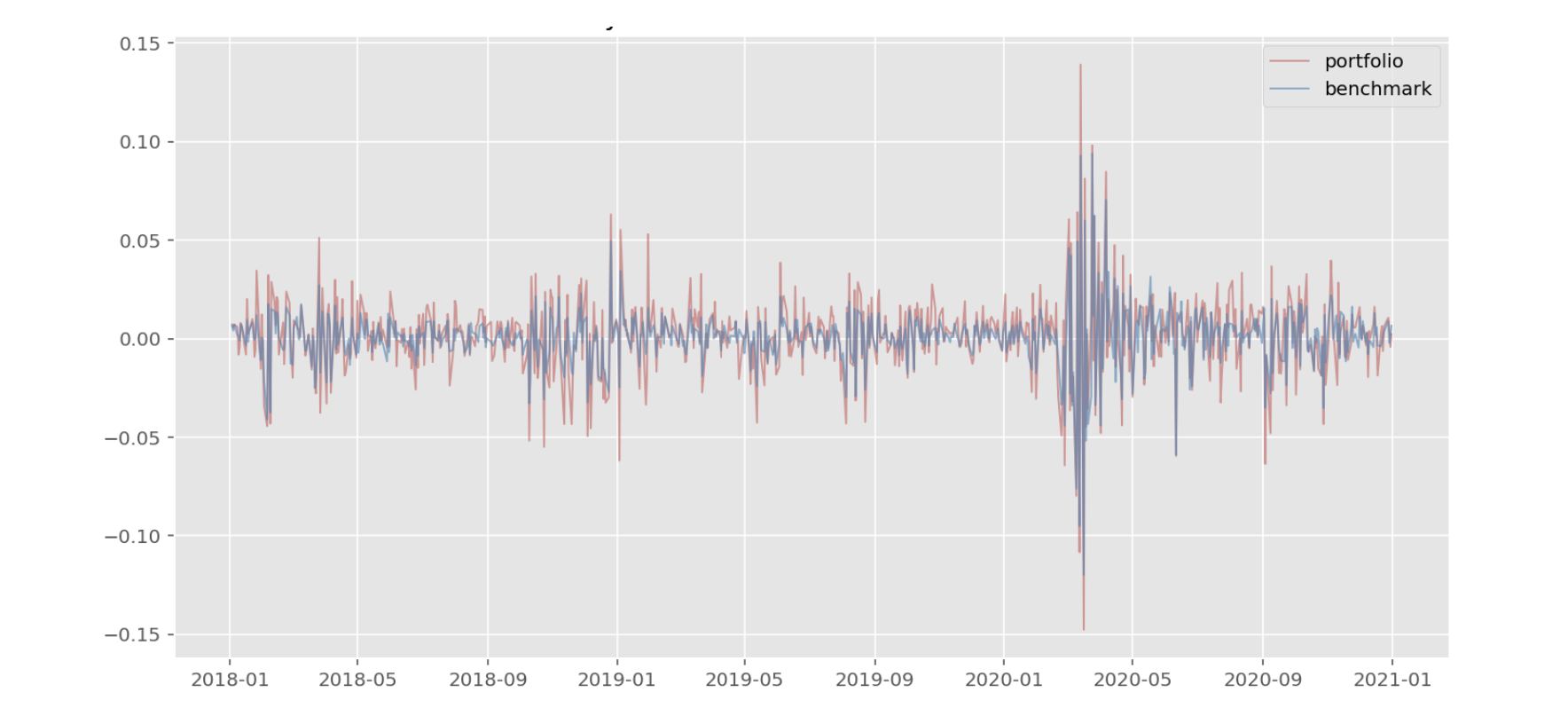

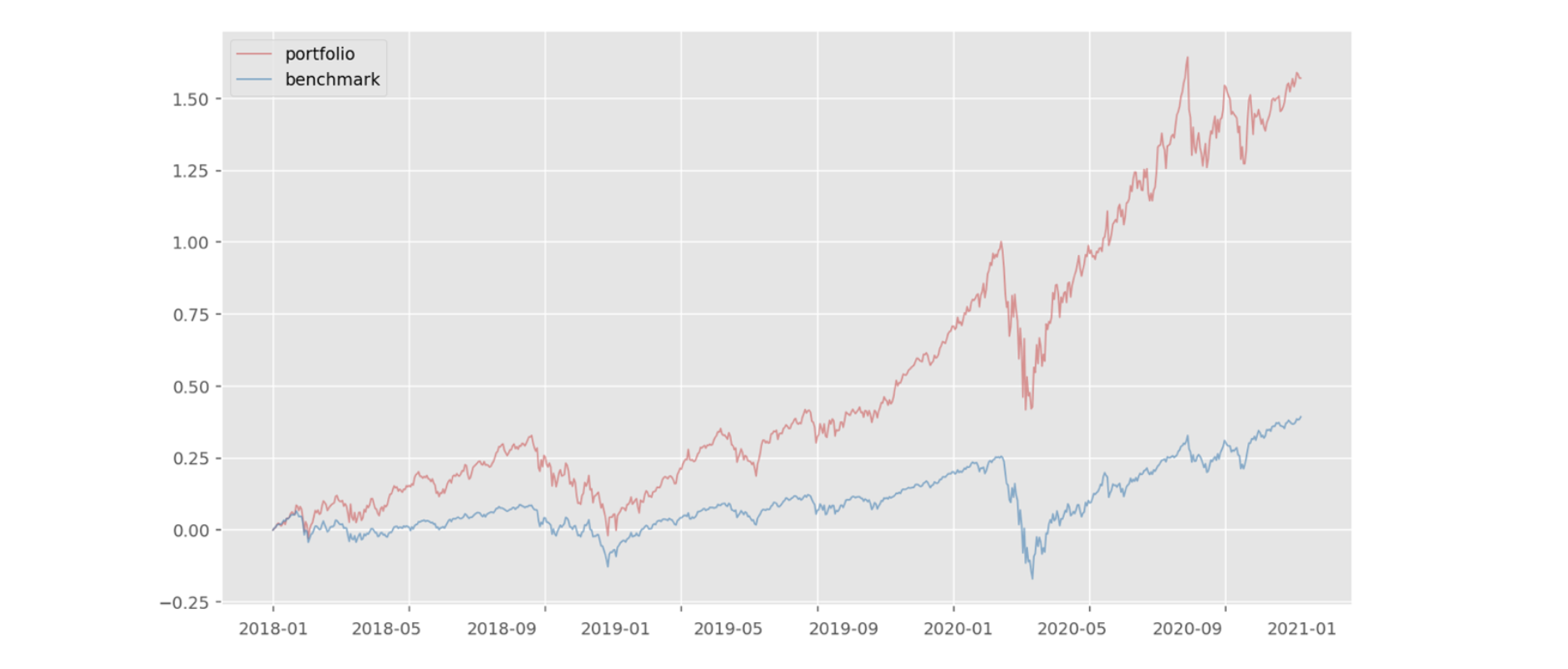

Using the above weights the daily return of the portfolio and the cumulative return of the portfolio is as shown below:

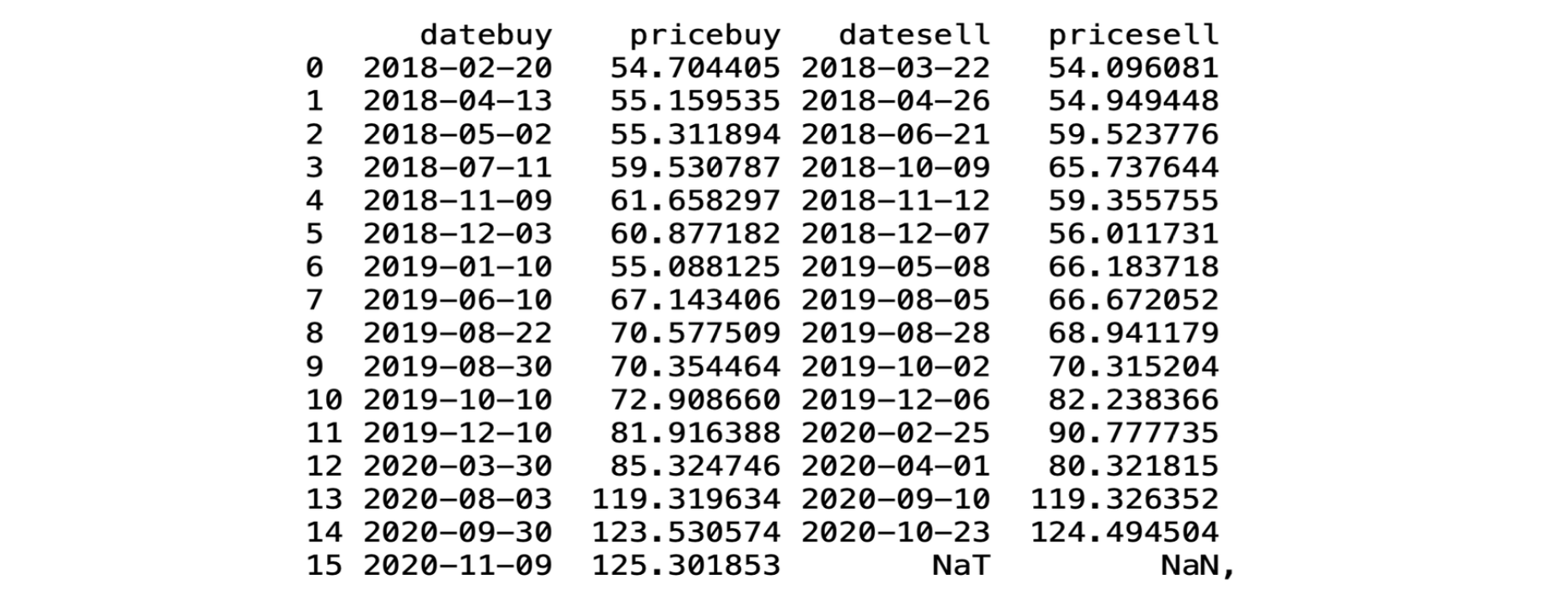

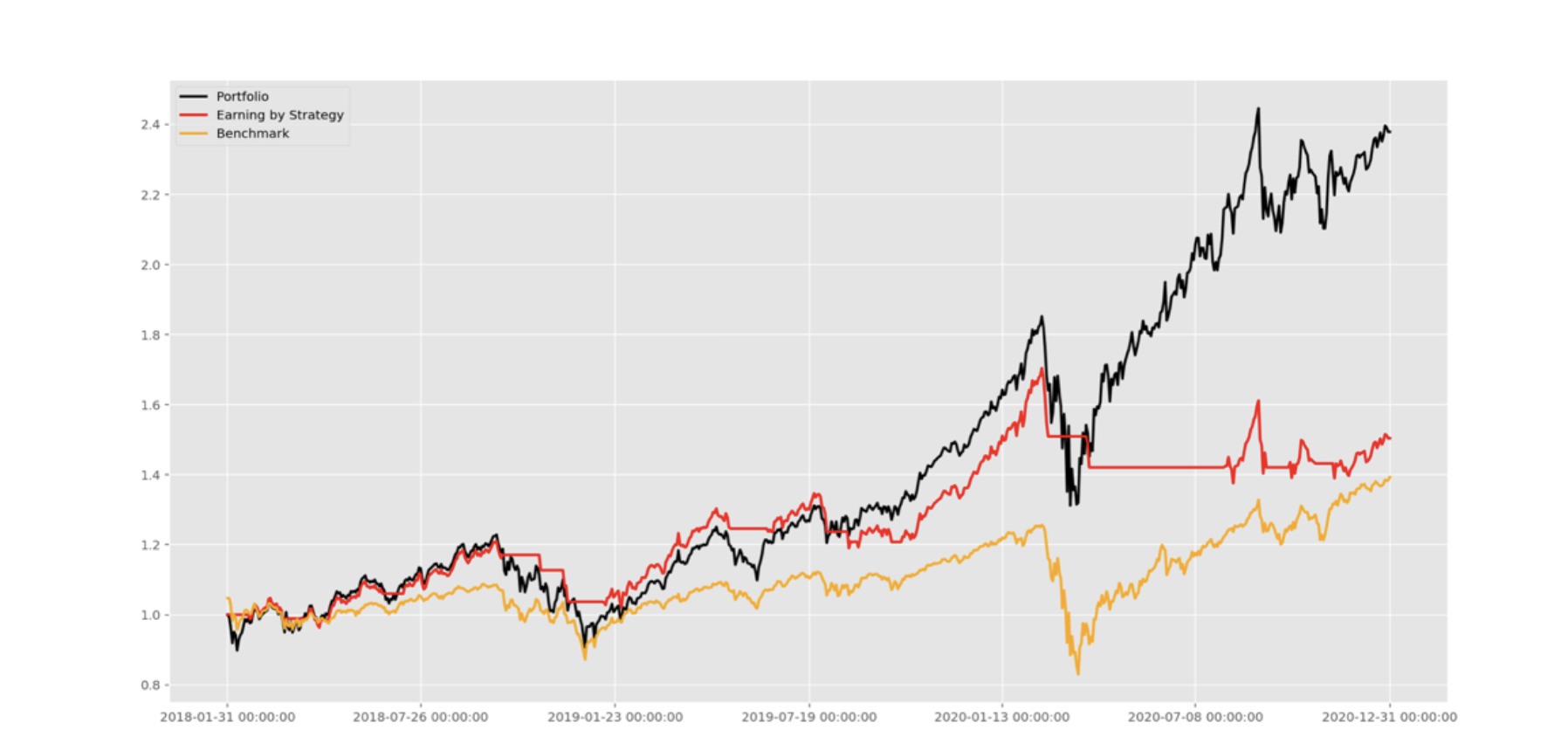

To test the return of the portfolio, the study used a backtesting strategy that involved taking long or short positions based on the short and long moving averages. The resulting trading history is presented in below Figure, which shows a positive Sharpe ratio of 0.94 and a victory ratio of 43.75%, indicating a relatively high return for the portfolio. Although the annualized rate of return is not high at 14.87%, the maximum drawdown and maximum single loss are acceptable. Figure below shows that the portfolio outperformed the benchmark S&P500, especially since 2020, but the backtesting strategy may not be suitable during this period. The study suggests that changing the investment strategy could potentially result in higher returns for the portfolio.

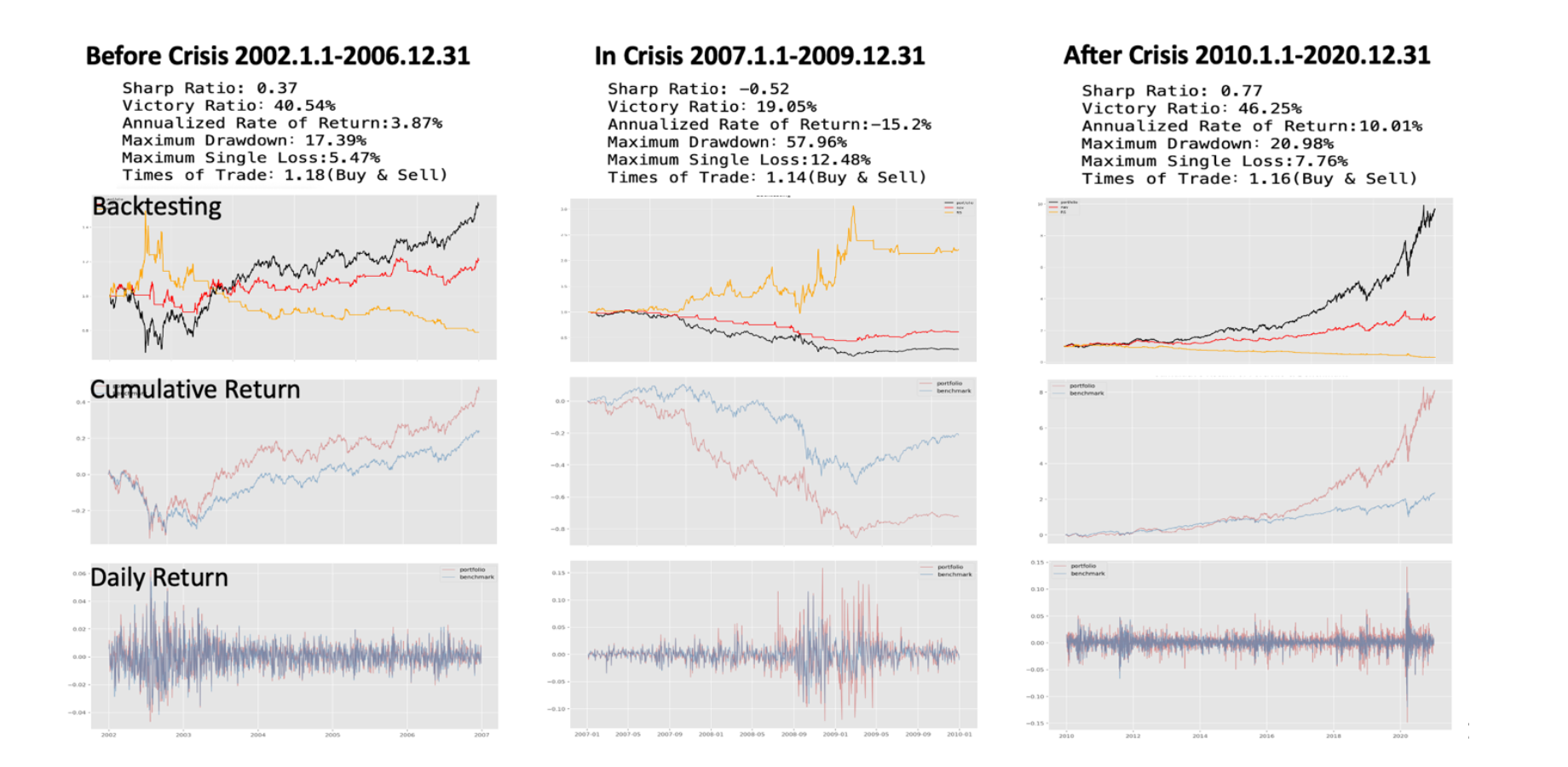

Finally, The study analyzed three market regimes and found that the DBHT method was flexible and consistently produced significant clusters. The portfolio outperformed the S&P500 in the post-crisis period but underperformed during the crisis, indicating higher risk. The study suggests paying attention to the interaction between the portfolio's stock selection and market circumstances.

Conclusion:

This article discusses the importance of diversification in investing and presents an asset allocation model that effectively diversifies risks. The model is based on the DBHT clustering algorithm and performs better than the market benchmark in backtesting tests. The article also evaluates the model's performance before- and after- the financial crisis and finds that the model has a good performance above the market benchmark in both periods. However, the model did not perform well during the financial crisis, indicating that it cannot be used to diversify risks during such times.