Abstract

The objective of this project is to implement a method to price electricity forward. It is based on a non-parametric structured hybrid electricity price model. We first investigate properties of the electricity forward risk premium. The data we use comes from a major American electricity market: PJM. After modeling each underlying factor related with the risk premium, we calculate the pattern of risk premium, then we try to extrapolate its pattern which can be used to derive the forward price.

Researchers:

Research Group (2015 Spring):

Zejian You, Master in Financial Engineering, Graduated in May 2015

Ze Feng, Master in Financial Engineering, Graduated in May 2015

Advisor:

Research Topics:

Electricity Market, Electricity Forward Pricing, Risk Premium

Conclusions

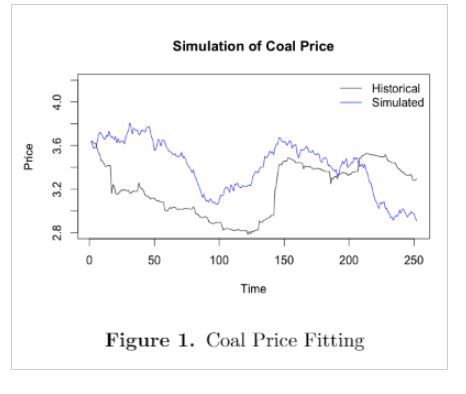

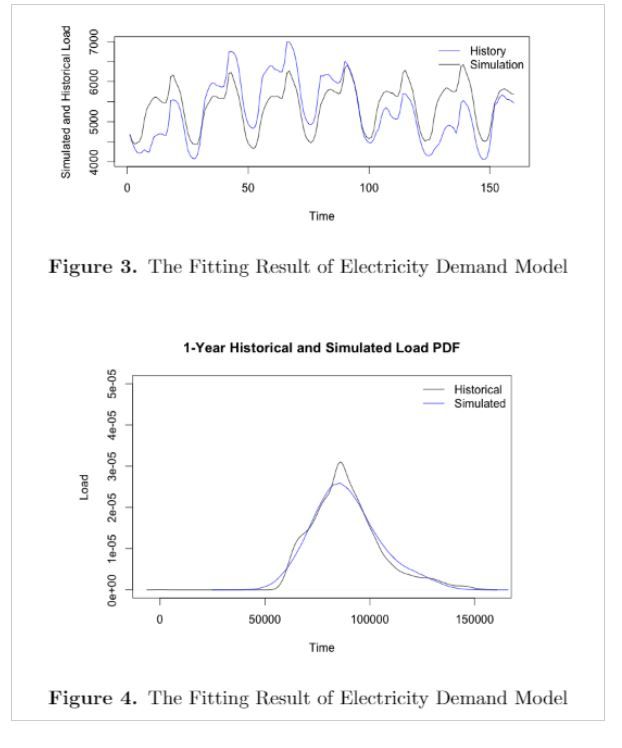

We achieved good results in approximating the electricity load model. Further improvements can be done in the future on regression model calibration. And more data is needed to have a more accurate back testing on gas and coal historical prices.