Abstract

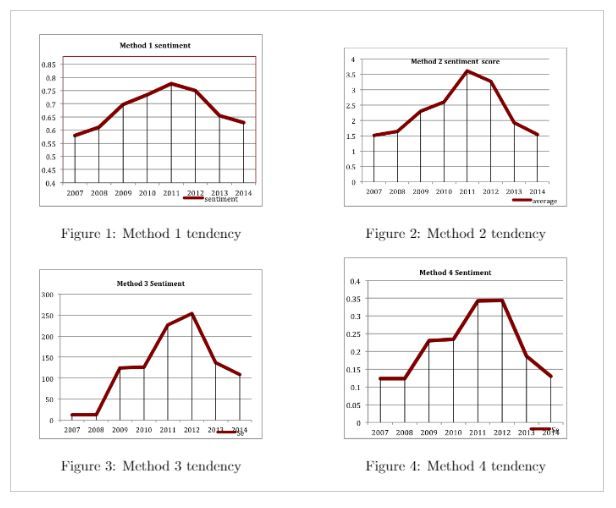

Our study aims to analyze customers' messages and attitudes about life insurance industry posted on social network from 2007 to 2014. From this we expect to grasp customer sentiment tendency and to infer potential factors. We first implement four methods to calculate the sentiment score.

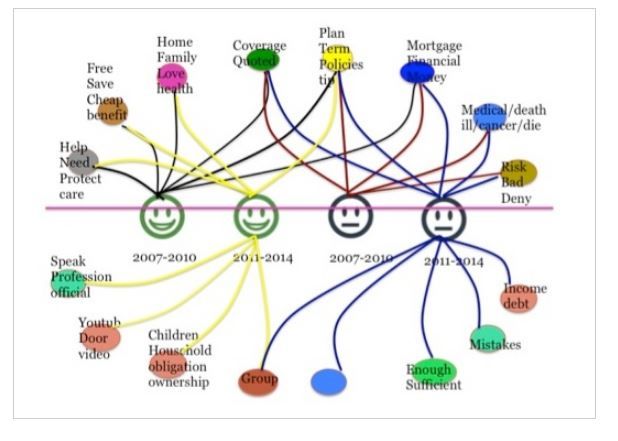

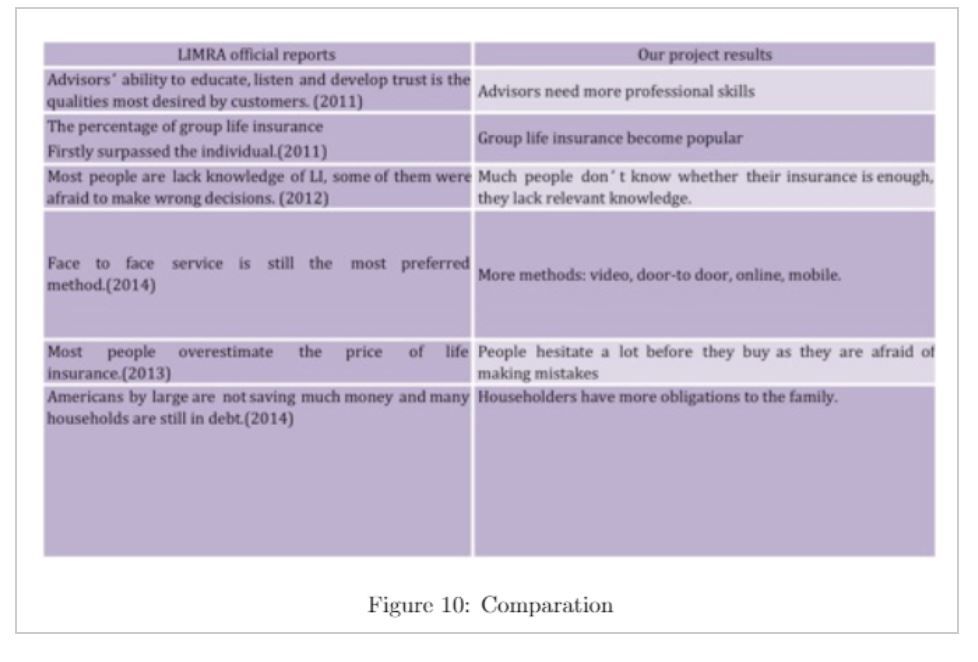

Then we use text-mining techniques to obtain the frequency words and do inferences on them. In the end, we compare our results with LIMRA (Life Insurance and Market Research Association) official report on aspects of life insurance.

Researchers:

Research Group (2015 Spring):

Zhongshu Zhao, Master in Financial Engineering, Graduated in May 2015

Advisor:

Dave Odonovan

Rohit Mangal

Main Results:

Our results lie closely with the LIMRA official report.

From 2007 to 2011, all our four methods show that insurance industry is getting more and more attention, but this tendency turns into a negative one from 2011 to 2014.

Conclusions

Our model has a high accuracy. The reason that the attention drawn to the insurance industry dropped from 2011 to 2014 may be that people overestimate the cost of life insurance. It might also be that the group insurance industry is rising, plus the bigger financial burden on households.

Another thing worth mentioning is that our model out beats the official report in time, because the official report only comes out once a year, our model closely monitors the sentiment on social network in real-time. This gives the insurance industry great advantage to modify policies and business decisions in a short response time.