Researchers:

Feihan Bian

Yujun Geng

Faculty Advisor:

Zhenyu Cui

Abstract:

The COVID-19 pandemic has had a major impact on the global economy, transforming how businesses operate. This paper examines the effects of the pandemic on businesses by analyzing market data, multiples, and estimates for different companies. The pandemic has disrupted supply chains, reduced consumer spending, and forced many companies to temporarily close or shift to remote operations, leading to significant changes in market prices and estimates. The impact of the pandemic has varied depending on the size, location, and industry of the company, as well as the severity and duration of the pandemic and government response measures. The study highlights the need for businesses to be adaptable and resilient in light of the unprecedented economic events caused by the COVID-19 pandemic.

Results:

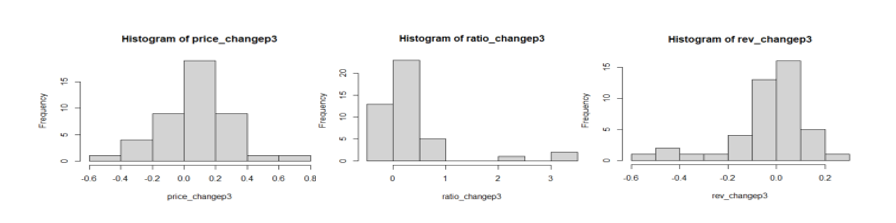

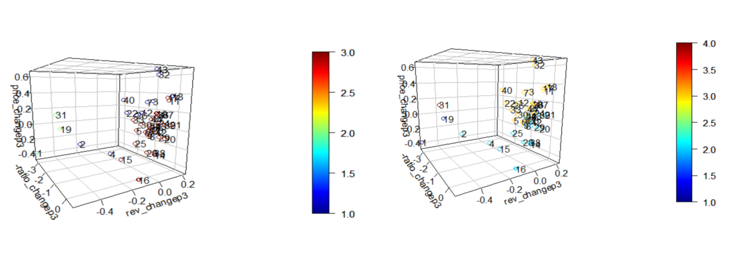

The paper evaluates three criteria. It utilizes and combines these 3 values; price_changep3, rev_changep3, ratio_changep3 for analysis

First technique: K-means clustering. Red, green, blue represents very well, not well and okay respectively

Second technique: Hierarchical clustering technique. Yellow, blue + red, cyan represents very well, not well and okay respectively

Third technique: Lp-norm, p=1 (Manhattan distance method)

The Smaller distance to this control point (i.e. minimum distance), the worse the company performed during COVID-19 period and vice-versa.

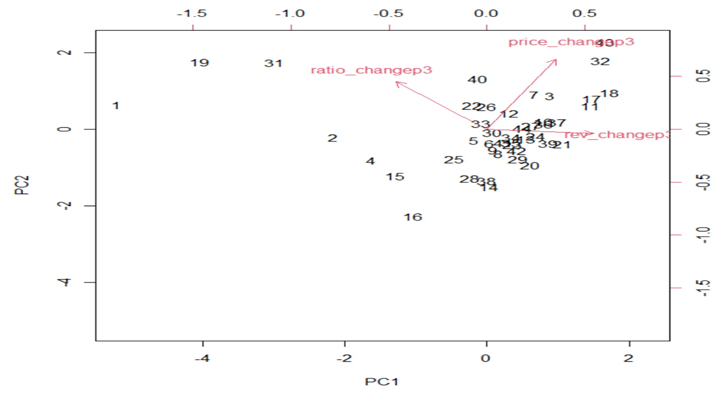

Fourth technique: Principal Component Analysis (PCA)

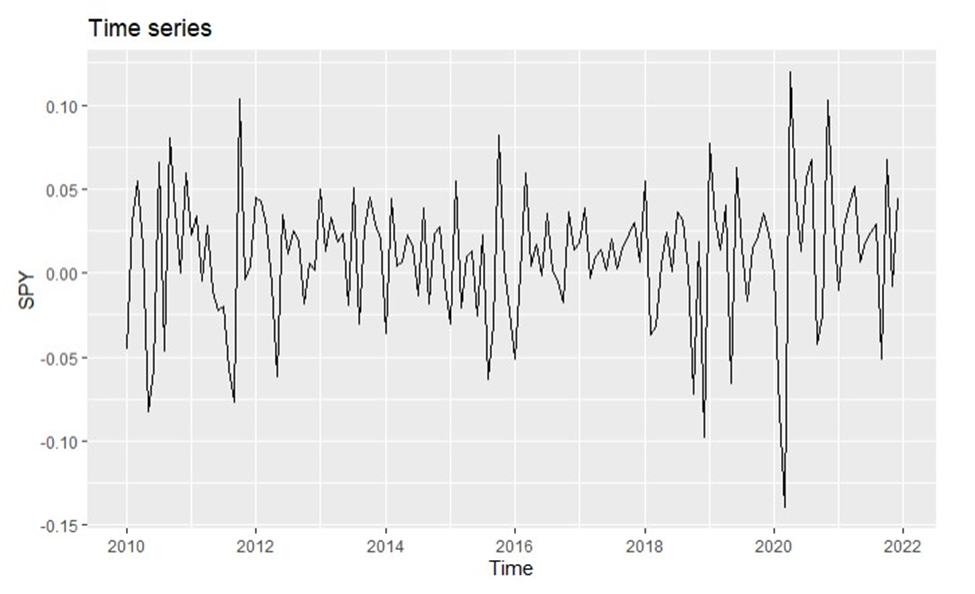

The paper also implements multiple regression model, correlation model and time series model to determine the impact of COVID -19

The test results show that the travel and hotel industry has seen a decline in revenue due to canceled plans and decreased bookings. The oil industry, has also suffered due to oversupply and declining demand.

On the other hand, companies in the consumer industry, including electronic goods, food, software, and online services, have done well, as people still needed to purchase products and food despite lockdowns and restrictions. Companies in payment services, parcel/delivery services, finance, insurance, and online entertainment have also performed well during this crisis. The pharmaceutical industry has also seen growth as people are looking to vaccines and cures as a solution.

Conclusion:

The utilization of unsupervised machine learning techniques on multi-dimensional data (price, revenue, and TEV/EBITDA ratio change) like K-means clustering, hierarchical clustering, Lp-norm, and PCA has successfully helped analyze the companies and classify them to showcase which industry are badly affected/benefited by the COVID-19 pandemic.

The transport, hotel, and energy industries are among those that are severely impacted. The consumer-related, online payment or delivery services, financial or insurance services, online entertainment, and pharmaceutical industries have all benefited from this problem.