Abstract

In this study, we propose CDO (Collateralized Debt Obligation) tranche valuation based on elliptical copulas and Archimedean copulas. CDO is a structured financial product that pools together cash flow-generating assets and repackages this asset pool into discrete tranches that can sold to investors. The intensity model by Dune and K.(1999) for default probability is assumed rather than structural model by Merton (1974). Furthermore, the recovery rate here is fixed at 40%. We apply bottom-up method, one factor Gaussian copula model, and top-down method, Archimedean copula model, to calibrate dependence structure between single name CDS in the pool. We investigate behavior of different dependence structures on CDO tranches.

Researchers:

Research Group (2015 Spring):

Jingqi Qian, Master in Financial Engineering, Graduated in May 2015

Xian Zhao, Master in Financial Engineering, Graduated in May 2015

Zixuan Jiao, Master in Financial Engineering, Graduated in May 2015

Advisor:

Dr. Rupak Chatterjee

Research Topics:

CDO, Copula

Main Results:

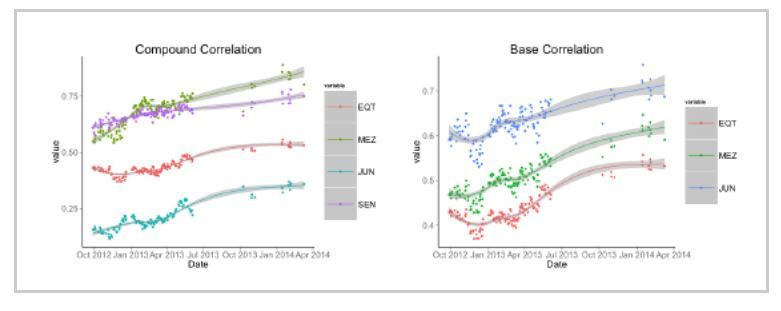

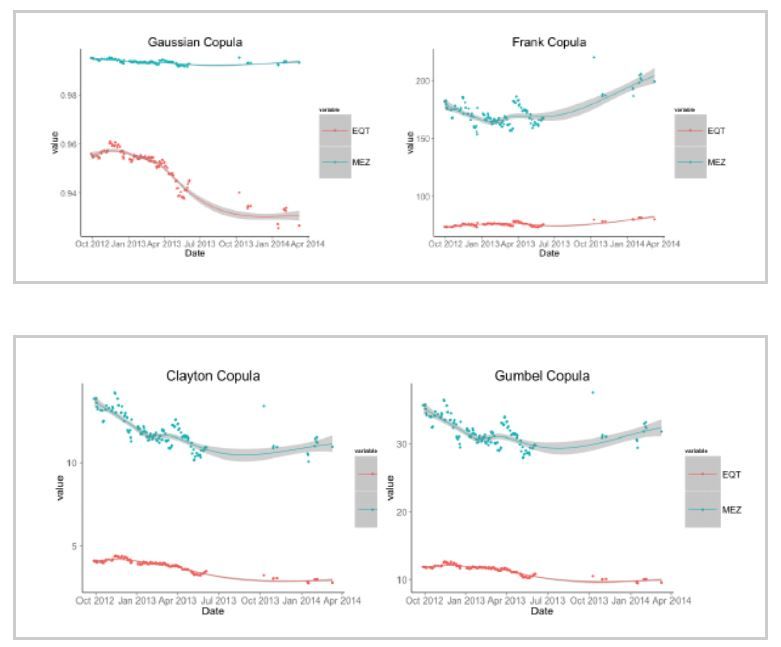

We use North America Investment Graded CDX Series 19 to perform our research. After we remove the unavailable data, we have 145 time points from October 2012 to April 2014. This time interval is quite different from other research papers, which are based on time interval before the financial crisis in 2008.

Conclusions

According to our research, we find that there is a big difference dependence structure in CDX than before.