Researchers:

Yuxin Tang

Yuzhu Jiang

Theodosios Dimitrasopoulos

Faculty Advisor:

Dr. Khaldoun Khashanah

Abstract:

Both statistical and machine learning models have been studied extensively for financial time series forecasting. Long Short-Term Memory Model (LSTM), a type of deep learning model, is better than simple Recurrent Neural Networks (RNN) and advanced statistical models like Autoregressive Integrated Moving Average model (ARIMA) in financial time series forecasting. LSTM can remember longer-term dependencies and extract non-linear patterns. Attention Mechanism can help LSTM to focus on important input features by assigning weights to them. Each model is trained independently and fine-tuned before being evaluated together. To achieve higher accuracy and lower loss, the models will be combined using an ensemble model. A comprehensive validation framework has been developed to assess the forecast accuracy of the models by analyzing Hit Rate, regression performance, portfolio performance with trading costs, and auto-correlation within residuals. Experimental results show that our time series prediction models are superior to the benchmark models, including the latest ARIMA and LSTM models.

Results:

1. Hypothesis:

Our hypotheses are that Hybrid model would have a better performance than traditional statistical models and Attention Model would beat the naive LSTM model in both statistical and trading performance. One-step forecast ARIMA is used to benchmark the performance of Hybrid model. LSTM model from literature proposed by Ioannis Livieris et al is used to benchmark the performance of Attention model.

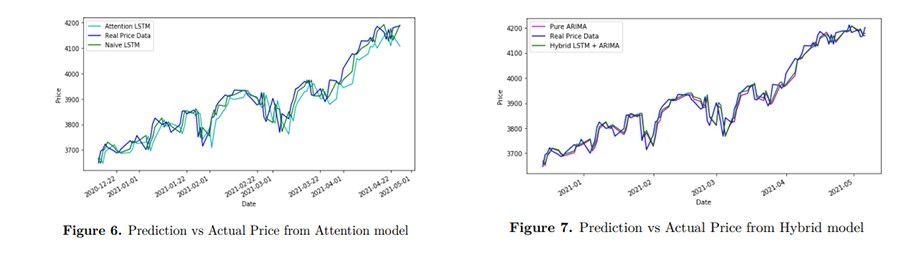

In the graphs below, we can see that predictions from both Attention model and Hybrid model do not deviate much from the true values.

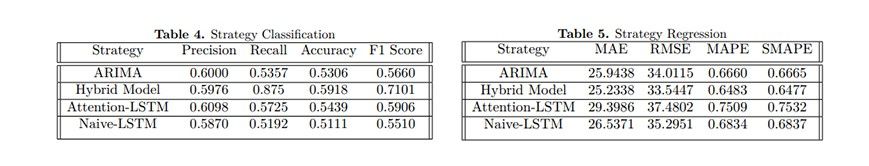

In the figure below, we see that the Hybrid model offers better performance in terms of these metrics but the Attention model does not surpass the performance of the Naive LSTM.

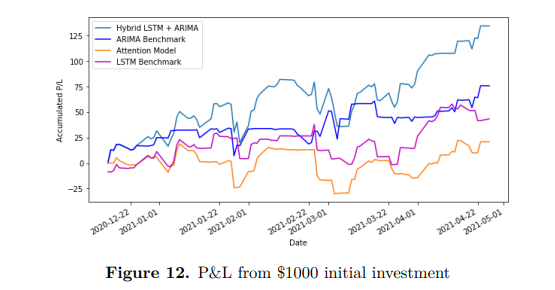

2. P&L from initial $1000 investment:

AQR Capital's 2018 study on trading cost found S&P 500 ETF's trading cost per transaction to be 4.72 basis points, which is assumed in this study to isolate performance metrics based on Profit and Losses of a long-only strategy. As the model is for day trading, incorporating the transaction cost could increase the accuracy of our model, making it more trustworthy to implement the strategy in the real stock market. The below graph shows what the Accumulated Profit and Loss will look like for this 100- day trading using different models if the initial investment is $1000

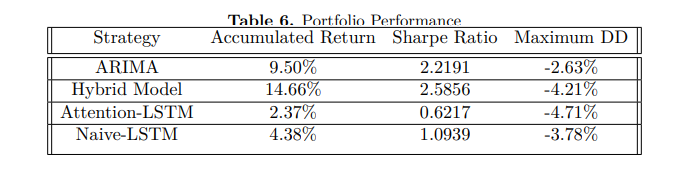

Below table shows the accumulated return, Annualized Sharpe Ratio and Daily Maximum Draw Down. From this result, we can infer that the Hybrid model indeed performs better than ARIMA, LSTM and Attention models altogether.

Conclusion

In conclusion, this project proposes a series of hybrid models for financial time series forecasting that showcase advantages over state-of-the-art ARIMA and LSTM models. The validation framework implemented evaluates the model's reliability in terms of statistical metrics and practical considerations of transaction cost during execution. The project highlights the importance of evaluating the reliability of testing results and analyzing the reasons for suboptimal performance. Attention Mechanism is shown to have clear advantages over traditional LSTM implementations due to its ability to remember longer-term relationships between various market factors. The model demonstrates significant improvements in regression errors when compared to naive LSTM benchmarks.