Researchers:

Ashley Fontes

Akshat Goel

Ameya Chitnis

Faculty Advisor:

Dr. Ionut Florescu

Dr. Christian Homescu

Abstract:

With this research, we compare the effect of using an ensemble model against a sole model on forecast accuracy of time series in Quantitative Wealth and Investment Management (QWIM) sphere. To create the ensemble model, we used a three-step approach of model development, followed by model trimming, and finally model pooling. We implemented multiple statistical and neural network methods and assessed their performance in forecasting daily returns over multiple horizons of one-month, two-months, and three-months. These forecasted values were expected returns of two portfolios – one of four exchange-traded funds (ETFs) and the other of ten stocks – which were both structured using mean-variance optimization. The ensemble model proved to reduce root mean squared error (RMSE) by a factor of ten. These findings provide a framework for the evaluation of models to be considered for an ensemble model used for more accurate forecasting of time series with the goal of use for a high performing trading strategy.

Results

ETF Portfolio

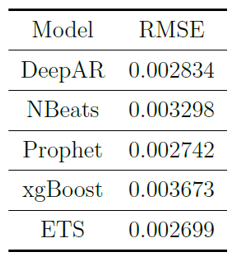

The resulting ensemble model used to forecast the returns of the ETF portfolio was a combination of DeepAR, NBeats, and Prophet. The XGB and ETS models were rejected as the cosine matrix proved these models had similar results to DeepAR, NBeats, and Prophet. The final Root Mean Squared Error (RMSE) of this ensemble model is 0.001085583. The table below shows RSME of all the models. The results indicate that the ensemble model performs better than each individual model.

Stock Portfolio

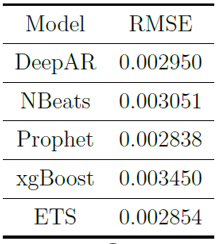

The resulting ensemble model used to forecast the returns of the stock portfolio was also a combination of DeepAR, NBeats, and Prophet. The XGB model was rejected due to its high RMSE value. The ETS model was rejected as the cosine matrix proved these models had similar results to DeepAR, NBeats, and Prophet. The final RMSE of this ensemble model is 0.0002805502.

Noting the individual models’ RMSE values as shown above, the results once again indicate that the ensemble model performs better than each individual model.

Conclusion

This research aimed to compare the prediction accuracy of a combination of models against a single model. With our research, we found cosine similarity to be a good measure of similarity that aids in the elimination of models, which in turn improved the accuracy of the final ensemble model used. The results indicate that the ensemble model performs better than each individual model evaluated. This is evident from the RMSE being reduced by a factor of ten for both the ETFs and stocks.