Abstract

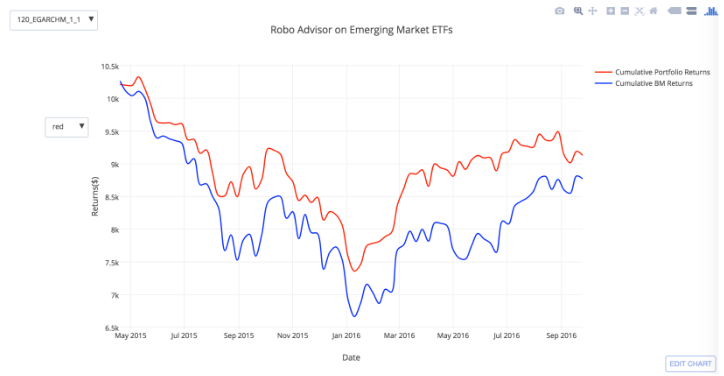

The aim of this study is to build a Robo Advisor based on Black-Litterman model (Black & Litterman, 1992). As an extension to its key function, adding investors' views into the portfolio, two time series learning models (EGARCH-M and ARIMA) are introduced and tested. Furthermore, a user interface is displayed to compare those two prediction models. It also compares the results from different combinations of parameters within them. Finally, the portfolio with the best performance is selected using empirical data. We input 14 emerging market ETFs diversified by 14 different developing countries. We expect to have a dynamic portfolio whose cumulative return would outperform the benchmark.

Researchers:

Research Group (2016 Fall):

Wei Li, Master in Financial Engineering, Graduated in Jan 2017

Yi Hao, Master in Financial Engineering, Graduated in Jan 2017

Jigar Jain, Master in Financial Engineering, Graduated in Jan 2017

Advisor:

Hani Suleiman

Dr. Peter Lin

Research Topics:

Robo Advisor, EGARCH-M, ARIMA, time series learning model, emerging market ETFs, dynamic portfolio

Main Results:

We have successfully implemented the Black-Litterman model, and extended it with time series learning models. As we can observe from the graph, the selected portfolio outperforms the benchmark.

Conclusions

In this study, an automated portfolio advisor is built for providing investment advices and for generating optimal asset allocation in each investment period. The result is displayed in the form of a time series of cumulative returns with different window lengths. For future study, relative views can be tested by discovering the relationship between each ETFs. Also we could try more time series models. By testing more combinations of data type, window length and parameters, we can get a better sense of how to build an optimal automated portfolio construction model.