Abstract

The main purpose of this study is to test and calibrate some of the existing models in contingent convertible bond pricing: the equity derivative model by De Spiegeleer and Schoutens (2012) and the structural derivative model by George Pennacchi (2010). CoCos are designed by regulators in response to the 2008 financial crisis, intended to increase bank liquidity by debt to equity wasp or bond principal writedowns. Details of the design of trigger events are discussed, then testings and calibrations of the selecting models are carried out on CoCo bonds issued by Barclay's bank.

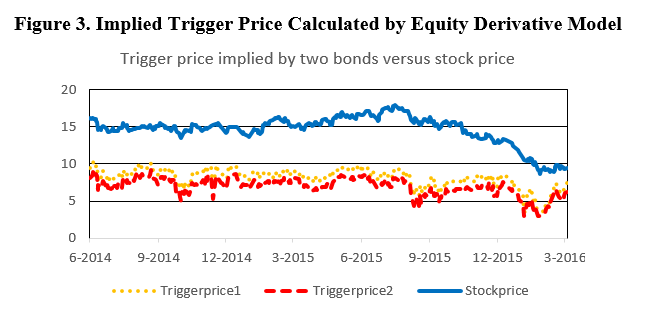

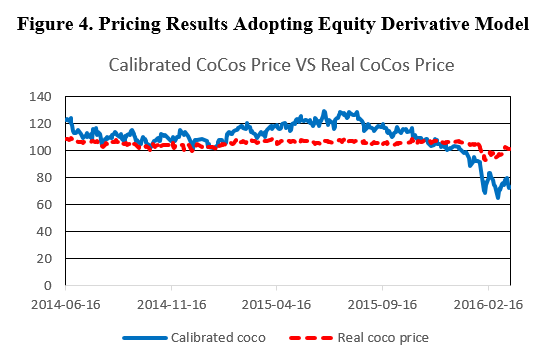

Equity derivative model assumes that the main driver of the CoCos price should be the stock price of the issuer. It replicates the CoCo via a normal bond, a knock-in forward and a binary down-and-in option. Under the empirical analysis, implied trigger price is calculated using the bisection method.

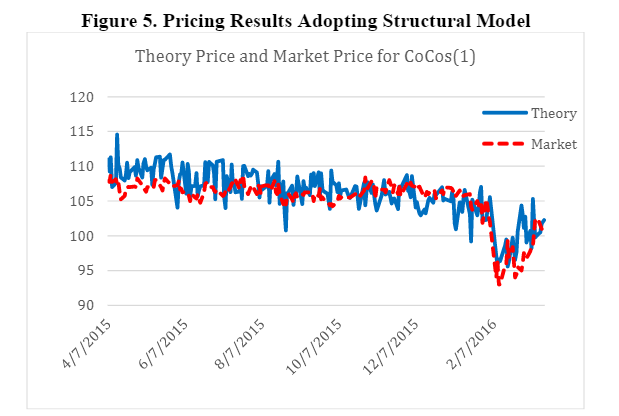

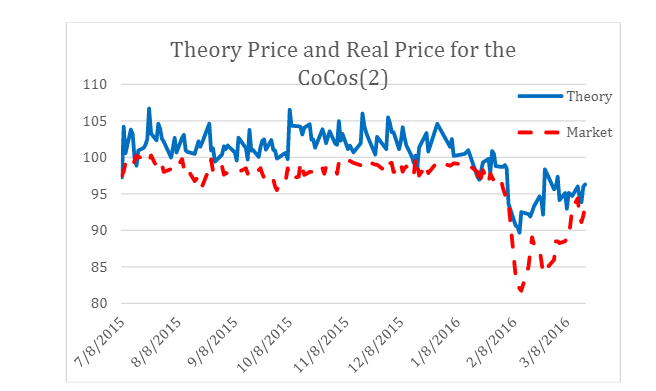

Structural derivative model incorporates equity, deposits, subordinated debt and contingent capital. While doing the empirical analysis, several parameter selections are performed, and the calibrations of the asset process formula are carried out as well.

Researchers:

Research Group (2016 Spring):

Yuanzhi Yao, Master in Financial Engineering, Graduated in May 2016

Yang Han, Master in Financial Engineering, Graduated in May 2016

Yan Wang, Master in Financial Engineering, Graduated in May 2016

Advisor:

Dr. Dragos Bozdog

Research Topics:

Contingent Convertible Bonds, Equity Derivative Model, Trigger Events, Structural Derivative Model, Parameter Calibration, CoCos Pricing

Main Results:

Although the structural model and the equity model are able to match the observed CoCo bond prices closely, they do still exhibit some substantial biases. In the equity model, it can be expressed as S*Trigger Price. In the structural model, several parameters are subject to estimation uncertainty because they are non-observable.

Under the structural derivative model, the root mean square deviation (RSME) of the two lines (the predicted and the real) is small. Then we use the parameter calibrated from Barclay's first CoCo bond to calculate another CoCos issued by Barclays, the RSME becomes larger. Four reasons are possible responsible for this:

- There is time lag in terms of choosing appropriate yield curve and common stock market value for every day.

- The daily CET 1 ratio is estimated which can cause errors.

- The liability and capital we considered is not comprehensive.

- There might exist some potential dilutive effect.

Under the equity derivative model, the RSME still has room for improvements. Two reasons are proposed to explain the gap:

- The coupon payment and principle redeem of the CoCo bonds are very flexible.

- The model does not take into account of the issuer's balance sheet.

Conclusions

We tested and calibrated two selecting models using Coco bonds issued by Barclay's bank. Our analysis of structural model and equity derivative model show that although all approaches are largely able to match empirically observed Coco bond prices, they do exhibit substantial biases.