Abstract

The major aim of this study is to model Equity Indexed Annuity (EIA) embedded guarantee and measure tail risk of the EIA. The popular approach to measure the tail risk is to use Heston Stochastic volatility model , but here we propose an alternative approach: Hidden Markov Chain . We first apply the hidden markov chain model to S&P 500 log returns.

The log returns of the equity index underlying the equity indexed annuity are modeled according to the following equation:

then we estimate model parameters using the Levin (2012) approach, after that we project the real world paths from the stochastic volatility model. Finally, we try to estimate the tail risk of the EIA.

Researchers:

Research Group (2016 Spring):

Gregory Slone, Master in Financial Engineering, Graduated in May 2016

Advisor:

Dr. Ionut Florescu

Main Results:

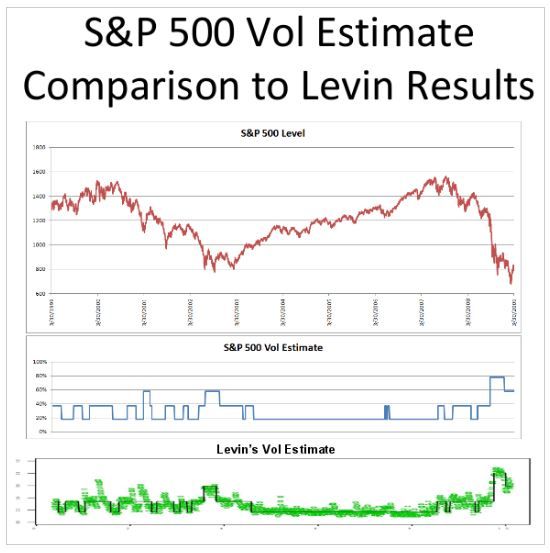

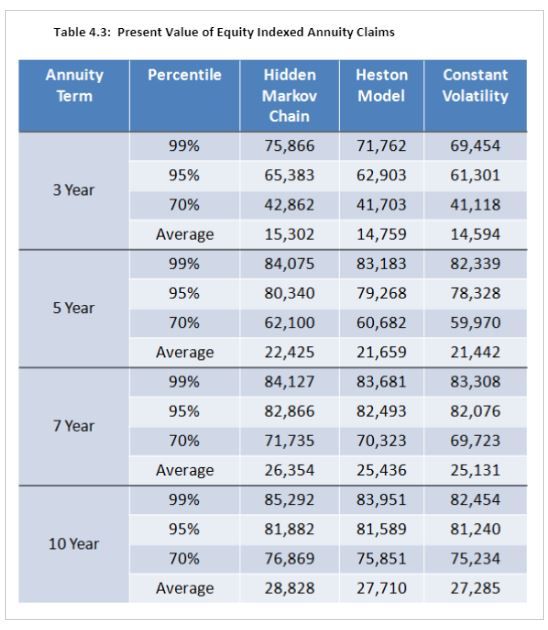

A four state hidden markov chain model was chosen for the stochastic equity index volatility, in order to validate the four state Markov Chain, the volatility estimates are compared against those from the Levin dissertation, then one million real world scenarios are generated and the present value of the claims under each scenario is captured:

Conclusions

The hidden Markov Chain approach to stochastic volatility modeling has been shown to be a reasonable alternative to the traditionally used Heston model, it better recognizes extreme tail volatility during market downturns. It provides higher average and tail annuity claims, which would result in higher reserves and economic and rating agency capital for the insurance company. One possible avenue for future research lies in integrating it with a fully stochastic interest rate model.

Research Topics:

Monte Carlo Simulation, Hidden Markov Chain, Heston Stochastic Volatility model, Equity Indexed Annuity