Researchers

Priti Bagaria

Tianna Saade

James Snyder

Faculty Advisor

Dr. Ionut Florescu

Abstract

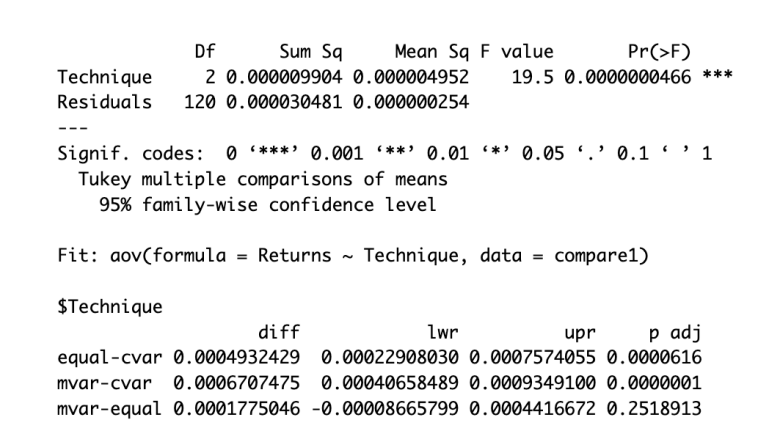

This research digs deep into the dynamic realm of portfolio optimization in search of producing results that can be used to enhance investment returns. The study leverages various optimization techniques such as Mean-variance, Conditional Value-at-Risk, and Equal Weighting. The strategy utilizes nine various commodity futures along with nine exchange-traded funds to find the best risk-adjusted returns. Each ETF is carefully introduced into different portfolios to dissect any impacts on the overall composition. Important risk metrics such as the Sharpe and Sortino ratios are the basis for evaluating the various portfolios. A one-factor ANOVA test is used to find comparative insights and shed light on each optimization approach’s attributes. The tests on each portfolio are crucial to discovering performance throughout the different financial landscapes that were examined. From the perfect financial storm to the unprecedented pandemic, the range of stress tests offers a one-of-a-kind understanding. As financial architects, our mission extends beyond the boundaries of analysis and embraces the evolution of financial markets to guide future exploration of optimization research. Keywords: Mean-Variance, Conditional Value-at-Risk, Equal

Introduction

In creating portfolios, investors seek innovative approaches to maximize returns while mitigating risks. Commodity trading, characterized by its unique market dynamics and inherent volatility, presents a compelling arena for exploration. This research endeavors to delve into the intricacies of portfolio optimization within the commodities market, employing modern portfolio theory (MPT) and sophisticated optimization techniques. The overarching objective is to construct portfolios that achieve superior risk-adjusted returns by judiciously selecting a combination of commodities that strikes the ideal equilibrium between risk and return. We hypothesize that the mean-variance optimization method will deliver the strongest performance. Our research aims to answer the following two questions: 1) What factors contribute to the optimal combination of assets for maximizing returns in a given trading strategy? 2) How do different portfolio compositions, considering various asset classes and hedging strategies, impact returns and risk in commodity trading?

Data

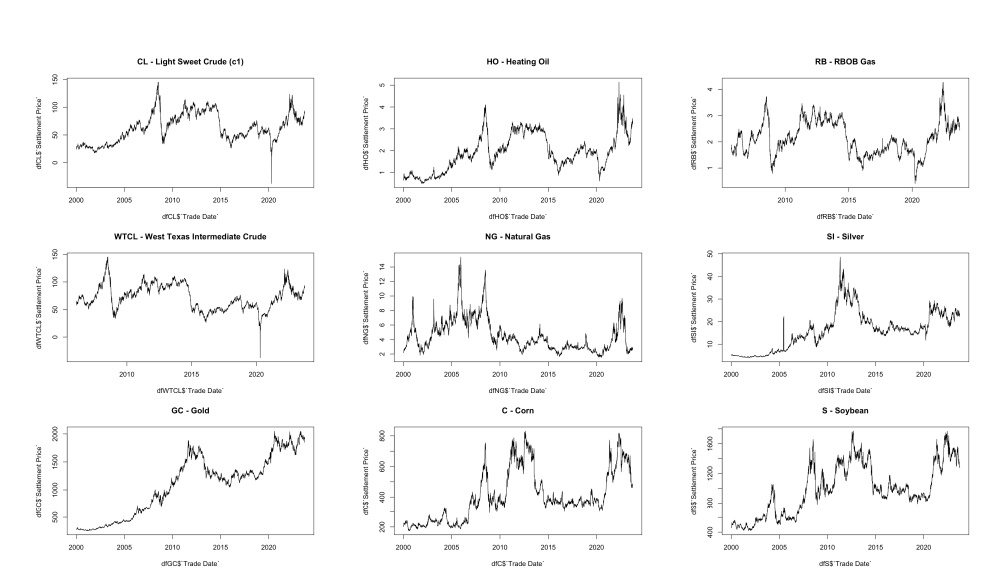

The data obtained consists of nine different commodities, as shown in figure 1, and they are Light Sweet Crude Oil( CL), Heating Oil (HO), Natural Gas (NG), RBOB Gas (RB), West Texas Intermediate Crude Oil (WTCL), Silver (SI), Corn (C), Gold (GC) and Soybean (S). The commodities’ data ranges from January 2006 to September 2023. There are one-month, three-month, six-month, and twelve-month continuing futures.

Summary

This research explores portfolio optimization techniques to enhance investment returns, focusing on approaches like Mean-Variance, Conditional Value-at-Risk (CVaR), and Equal Weighting. It examines nine commodity futures and nine exchange-traded funds (ETFs) to identify portfolios that offer optimal risk-adjusted returns. The evaluation is based on risk metrics such as the Sharpe and Sortino ratios, with a one-factor ANOVA test used to compare the performance of different optimization methods. Additionally, the study stress-tests the portfolios across significant financial events, including the 2008 economic crisis and the COVID-19 pandemic, providing valuable insights into market behavior and optimization strategies.

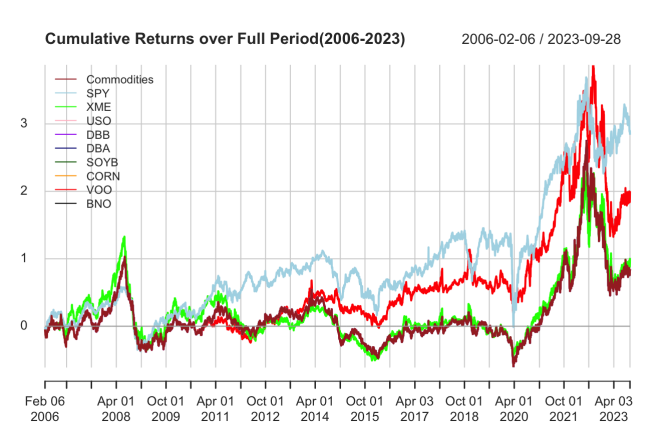

The analysis reveals that while simple equal-weighted portfolios fail to deliver strong returns, portfolios optimized for the maximum Sharpe ratio perform better, particularly during market recovery periods. Although CVaR optimization effectively manages extreme downside risk, it does not outperform Mean-Variance optimization in most scenarios. The ANOVA test shows that differences in performance between Mean-Variance and CVaR were statistically significant. Non-commodity ETFs like SPY and VOO consistently outperform commodity-based ETFs and commodities in typical market conditions, but commodities demonstrate resilience and deliver higher returns during financial turmoil, serving as robust hedges.

Overall, the findings indicate that while advanced optimization techniques like CVaR help manage risk, a straightforward Mean-Variance approach focusing on non-commodity ETFs generally offers superior long-term returns. However, commodities retain their importance as effective risk management tools during market instability, highlighting their role in a well-balanced portfolio.

Conclusion

In conclusion, our analysis indicates that the average returns between Mean-Variance optimized portfolios and equal-weighted portfolios show negligible differences, suggesting that the complexity of Mean-Variance optimization may not consistently yield superior returns compared to a more straightforward equal-weight strategy. However, a striking contrast is observed when we introduce the Conditional Value at Risk (CVaR) strategy into the comparison. The Mean-Variance portfolio, optimized for the maximum Sharpe Ratio, not only diverges from CVaR in terms of average returns but also significantly outperforms it, boasting the highest average daily return rate of 0.0009384329 against CVaR’s 0.0002676852 and the equal-weighted portfolio’s 0.0007609284. This pattern holds regardless of the specific commodity-linked ETFs included, with the portfolio weights displaying remarkable stability across various time frames. It is noteworthy, however, that non-commodity-linked ETFs generally offer better returns in most market conditions. The exception to this trend occurs during financial crises, where commodity-linked ETFs and commodities have historically provided more robust returns, underscoring their potential value as a hedge in turbulent market environments