Abstract

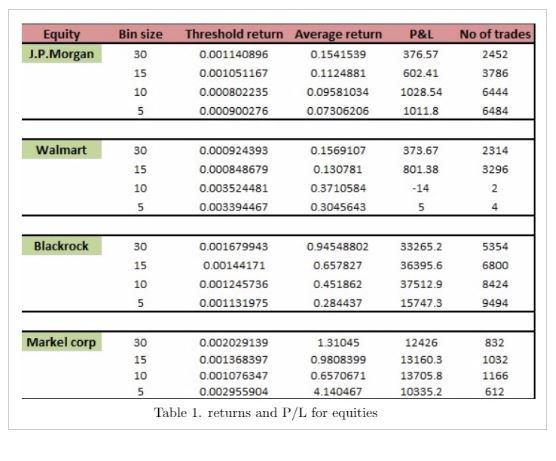

The aim of this study is develop methodologies for detection and analysis of rare events using financial data. The methodology is applied to a data set of equities over a period of five trading days. Classification criteria are implemented to detect rare events. A dynamic model is developed which will readily point out a rare event when the data is fed inside. A trading strategy is developed to gain profit from rare events. Below we attach the trades generated and P&L based on the strategy for four stocks with different liquidity levels.

Researchers:

Research Group (2015 Spring):

Siddharth Gala, Master in Financial Engineering, Graduated in May 2015

Palak Nagarsheth, Master in Financial Engineering, Graduated in May 2015

Binoy Kapadia, Master in Financial Engineering, Graduated in May 2015

Advisor:

Dr. Dragos Bozdog

Main Results:

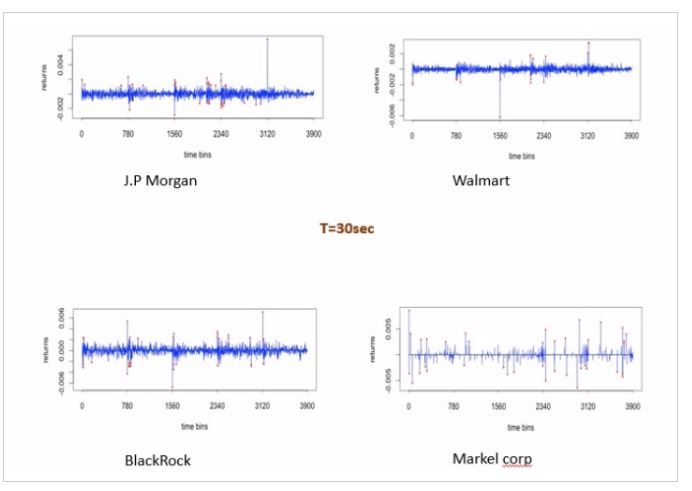

Usually after the occurrence of a rare event, the equity returns back to its previous level and thus the returns can be obtained in the proximity of rare event bin. Another striking observation is that the occurrence of a rare event is higher in a low volume traded equity:

and we observe most number of rare events at the start and the end of trading days. Finally, since less traded stocks have less liquidity, the price recovery after a rare event is slower compared to very liquid stocks.

Conclusions

The methods used in the study successfully provide a framework for the development of early warning systems for financial perplexity. We can utilize the patterns we observe from the study to profit from the financial market.

Research Topics:

Rare Events Detection, Price Recovery