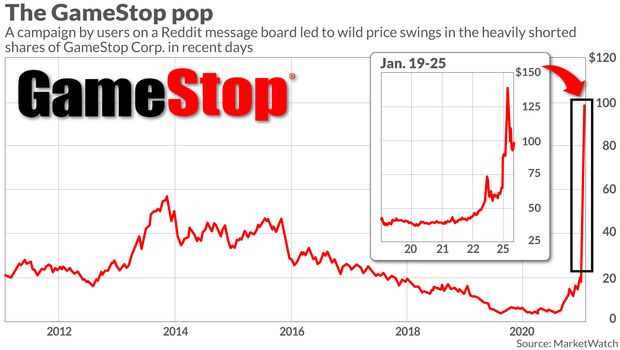

Speaking on Gamestop’s recent eruption this past February, Professor Calhoun counters the opinion that the investors involved in the stock were acting with wildly irrational motives. He proposes that the market itself is not exactly “rational”; that “share prices no longer reflect the underlying asset-value”. But Calhoun suggests that the GME event is actually the result of a process that is hyper-rational. Outlining the standard assumptions of the stock market, Calhoun goes on to describe the several situations where one or both of these assumptions are invalid. Using these examples, he explains how the GME event came to be, and how Reddit users designed a novel and extremely effective corner by combining two different techniques: a short squeeze, which is relatively well understood, and a new innovation called a Gamma Squeeze.

George Calhoun is the Director of the Hanlon Financial Systems Center as well as the Founder & Director of the Quantitative Finance Program at the Stevens Institute of Technology. He has spent 25 years in the high-tech segment of the wireless communications industry. He is author of several books on wireless technology, and his new book "Price & Value: A Guide to Equity Market Valuation Metrics" was published this year (2020) by Springer/Apress.