Abstract

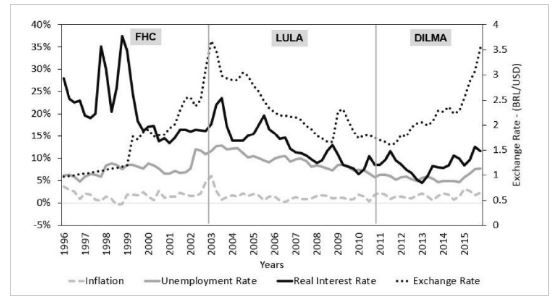

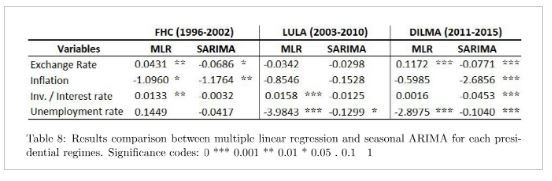

The priority of this study is to try to identify the effects of exogenous variables on Brazilian private consumption. Brazil is facing the deepest triennium recession of the last 100 years, it is hence important to evaluate how the main component of aggregate demand: private consumption has evolved over time. We use three models: MLR (multiple linear regression), SARIMA (seasonal arima) and VECM (vector error correction model) based on the following factors: unemployment rate, interest rate, dollar exchange rate and inflation rate to try to see if we can find the most influential factor and the best model. FHC, LULA and DILMA represent different presidential regimes.

Researchers:

Research Group (2016 Spring):

Marcus Braganca, Master in Financial Engineering, Graduated in May 2016

Rodrigo Andrade, Master in Financial Engineering, Graduated in May 2016

Advisor:

Research Topics:

Brazil Private Consumption, MLR, S-ARIMA, VECM, presidential regime

Main Results:

The VECM impulse response functions show that the private consumption response to shocks in the dollar rate fluctuates from positive to negative over 3 quarters cycle.

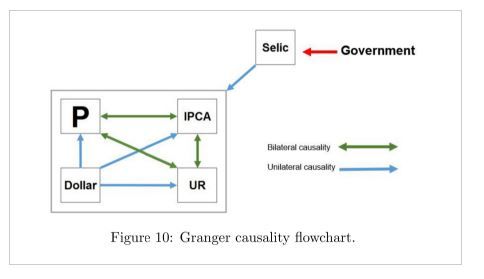

The Granger causality test suggests the existence of more than one endogenous variable, requiring simultaneous equations model to evaluate interdependence of variables.

Conclusions

All three models agree that innovations in interest rate, unemployment rate and inflation would result in the decrease of private consumption. Although private consumption had a trend of positive growth throughout the sample period, it is still different in each of the presidential regimes over the past two decades. Therefore it is also interesting to assess how is the influence of these factors in different economic and political scenarios.