Abstract

The main objective of the project is to create an analytic engine for financial advisors to utilize. It will serve as an aid to make decisions in the best interest of the client. We suggest a rollover of client's 401(K) portfolio which has a similar risk profile and has optimized returns. The risk-return optimized portfolio will be in line with Department of Labor's Fiduciary standards for Conflict of Interest. We will also include a stress testing feature in our optimizer. In the end, we compare performance of clients existing 401(K) portfolio with the proposed portfolio.

Researchers:

Research Group (2016 Fall):

Bhaumik Doshi, Master in Financial Engineering, Graduated in Jan 2017

Manoj Shenoy, Master in Financial Engineering, Graduated in Jan 2017

Praneet Beereddy, Master in Financial Engineering, Graduated in Jan 2017

Advisor:

Charles Ludden

Jae Ko

Special Thanks:

Dr. Zhenyu Cui

Dr. Ionut Florescu

Research Topics:

Portfolio Optimizer, GUI, Stress Testing, VaR, 401(K), Fiduciary Standards for Conflict of Interest

Main Results:

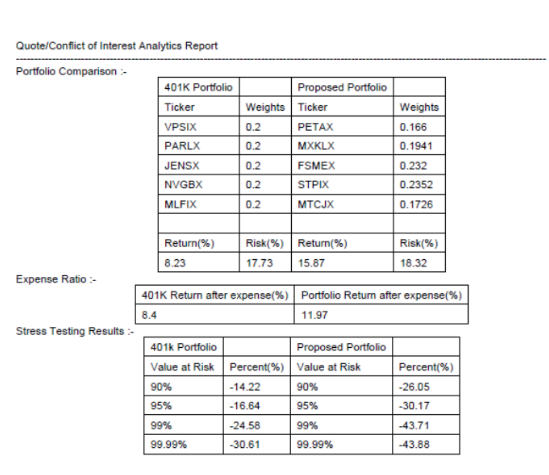

The analytic engine checks for compliance of Fiduciary rule by suggesting optimized portfolio as guidelines for advisors. In all test cases, Accenture Portfolio Optimizer is able to aid the financial advisor to stay in compliance with Fiduciary standards. Below we attach one sample pdf output of the optimizer.

Conclusions

From various test cases performed and results obtained, we can conclude that the portfolio optimizer tool has demonstrated success in proposing optimized portfolios that takes into consideration the client's risk profile to give better returns and in compliance with the DoL Fiduciary rule.