Researchers

Prudhvi Reddy Muppala

Vivek Ashok Kumar Herur

Faculty Advisors

Dr. Khaldoun Khashanah

Abstract

This study explores bubble and flash-crash phenomena in major cryptocurrencies from 2019-2023. Using the Augmented Dickey-Fuller test, it identifies unsustainable price rises and rapid market drops, examining their causes, durations, and recovery patterns. The study aims to provide insights into risk management and regulatory implications in the volatile crypto landscape.

Introduction

Cryptocurrencies, marked by high volatility, frequently experience bubbles and flash-crashes. This research uses statistical and market data to understand these events in Bitcoin, Ethereum, and altcoins. The study examines factors causing bubbles and sudden drops, using models to identify and capitalize on these patterns for investment strategies.

Objectives

The study aims to:

- Detect speculative bubbles using econometric tests.

- Analyze flash-crash events for causes, durations, and recoveries.

- Assess risks and back-test trading strategies.

- Provide regulatory insights for handling cryptocurrency volatility.

Methodology

The analysis uses a three-part approach:

- Bubble Detection (Augmented Dickey-Fuller Test): This model tests for explosive price growth, signaling bubbles in crypto prices.

- Flash-Crash Detection (Rate of Price Change): A significant price drop within one minute flags a flash crash.

- Recovery Rate: Examines the pace at which prices recover post-crash, identifying resilience and potential for market recovery.

Data

Data from Kaiko Database on Binance (2019-2023) includes Bitcoin, Cardano, Doge, Ethereum, Solana, and Ripple, covering daily and intraday prices. The dataset is pre-processed, segmented for bubble detection, flash-crash analysis, and recovery rate calculation, providing insights into volatility, liquidity, and resilience in the cryptocurrency market.

Results

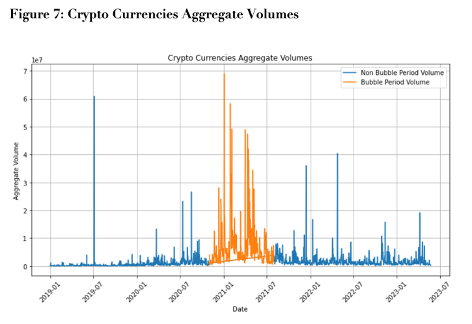

Bubble Detection: Bubbles were observed in five cryptocurrencies between 2020 and 2021, excluding Ripple. These periods saw trading volume surges, indicating speculative market activity.

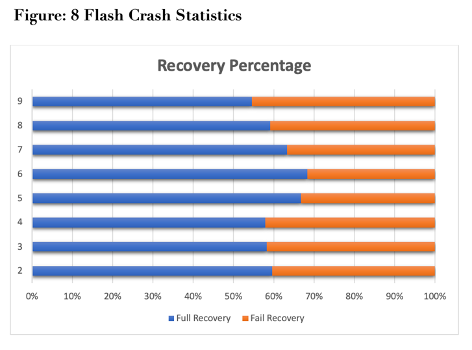

Flash Crash: Applying a 5% one-minute price drop threshold, significant flash crashes were detected, particularly in Solana. Recovery varied by crash severity.

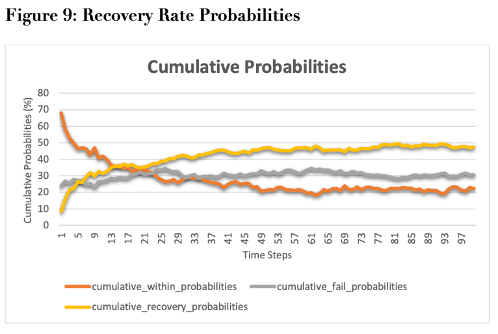

Recovery Rate: Analysis showed that smaller threshold crashes had higher recovery probabilities, with market resilience stronger during non-bubble periods. Approximately 50% of all crashes fully recovered.

Flash Crash Trading

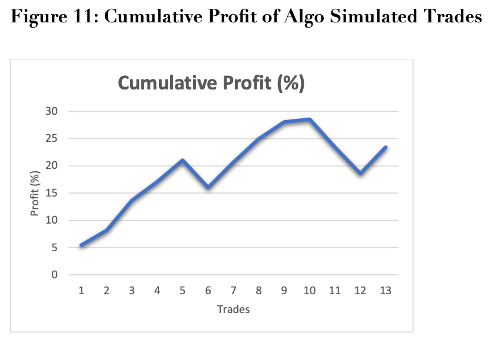

A trading strategy based on flash crashes with specific entry and exit rules yielded a cumulative 25% profit. The strategy identifies entry points based on post-crash recovery thresholds, offering insight into timing trades around rapid price drops.

Conclusion

The study concludes that bubbles and flash crashes are prevalent in crypto markets, with non-bubble periods showing higher recovery potential. The 5% crash threshold strategy proved profitable, but further research is needed on external market factors, regulatory impacts, and social media sentiment, which may refine trading strategies and regulatory measures.