Researchers

Francesco Cernigliaro

Valeriano Palmieri

Hritik Prajapati

Faculty Advisor

Prof. Khaldoun Khashanah

Abstract

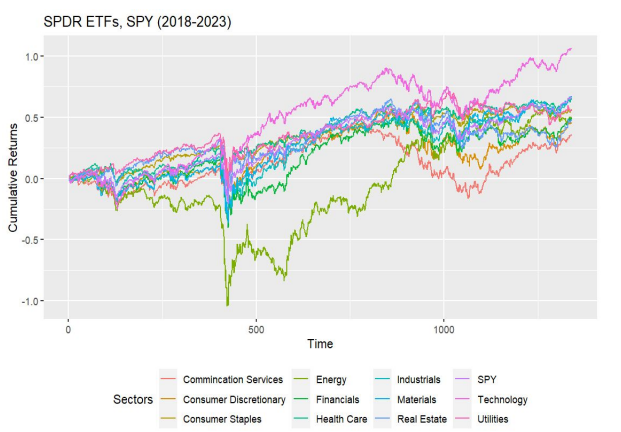

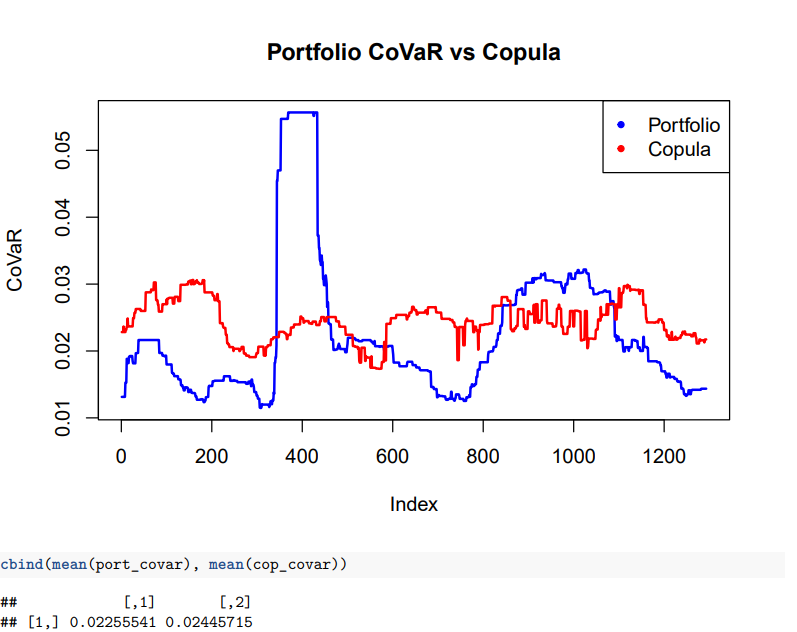

This project explores the systematic risk within the S&P sectors, analyzing data through Exchange-Traded Funds (ETFs) over two key periods: 2018-2023 (pandemic period) and 2006-2011 (financial crisis). The study applies Value at Risk (VaR) and Conditional Value at Risk (CoVaR) to evaluate individual and systemic risks across 11 sector ETFs, as well as the SPY ETF, which represents the broader market system. Utilizing techniques such as rolling windows, heatmaps, and copula modeling, the analysis provides insights into the dynamics of risk within the financial market. The results show that sectors with higher individual risks tend to have lower systemic risks. Consumer Staples and Healthcare exhibit the highest systemic risk resilience, while Energy shows the highest individual risk but lower systemic influence. Gaussian Copulas were applied to model the dependencies between sector returns, although limitations were observed in capturing extreme risk scenarios. Further studies are recommended using alternative models like Vine Copulas for better risk management strategies during extreme market events.

Introduction

In the realm of financial analysis and risk management, understanding the dynamics of various market sectors and their interplay is paramount for informed decision-making. This project delves into an exploration of the S&P sectors, as delineated by the Global Industry Classification Standard (GICS), through the lens of Exchange-Traded Funds (ETFs). Specifically, it focuses on the SPDR ETFs representing 11 distinct sectors, along with SPY and VIX, encompassing the period from 2018 to 2023 at a daily frequency. The project unfolds with a multifaceted approach, beginning with the download and aggregation of historical data for the identified ETFs. Subsequently, the analysis ventures into the realm of risk assessment, employing the Value at Risk (VaR) metric to gauge the potential losses within a ten-day horizon. Utilizing an empirical distribution technique, VaR calculations are conducted for each ETF as an individual portfolio, offering insights into their standalone risk profiles. Building upon this foundation, a 100-day rolling window risk analyzer is crafted to delve deeper into the risk dynamics. By amalgamating the SPY ETF with the sector ETFs, this analyzer provides a comprehensive view of risk evolution over time. Through the lens of rolling windows, the VaR for the combined portfolio is scrutinized, providing a nuanced understanding of risk exposure within varying market conditions. Furthermore, the analysis extends to consider the systemic risk inherent within the SPY ETF, conceptualizing it as a composite of the sector ETFs. The calculation of CoVaR (Conditional Value at Risk) offers a perspective on the interdependencies and contagion effects within the broader market ecosystem. In addition to quantitative assessments, the project seeks to elucidate the risk landscape through visual means. A heatmap visualization is crafted to depict the distribution of risk over the five-year period, capturing snapshots at the conclusion of each month. Finally, the project delves into the realm of copulas, seeking to approximate the joint distribution of returns for the 11 sector ETFs. This exploration culminates in a reevaluation of portfolio risk within the copula framework, offering a holistic perspective on risk management strategies.

Data

The SPDR ETFs track various sectors of the SPY, with two key time frames used for analysis. The period from 2018 to 2023 is utilized to assess the impact of the COVID-19 pandemic, while the 2006 to 2011 period focuses on the 2008 financial crisis. Notably, the Communication Services and Real Estate sector ETFs were introduced after the financial crisis, meaning they were not part of the earlier analysis. The SPY ETF serves as a representation of the overall system, with the SPDR ETFs acting as the components of the broader market.

Summary

In conclusion, this project provided key insights in relation to system risk of the SPY. There was an overall rough inverse relationship between VaR and CoVaR. In general, sectors with higher individual risk possessed a lower systematic risk. More specifically, the Consumer Staples and Healthcare sectors possessed the lowest individual risk and highest systematic risk across financial crisis and COVID periods that were examined. On the other hand the Energy sector possessed a high level of individual risk and low level of systematic risk across both time periods. This indicates that the Consumer Staples and Healthcare sectors are the most resistant to market shocks and their movement have a high amount of impact on the overall market. The Energy sector is the most exposed to market shocks but its movement has a low impact on the overall market. Guassian Copula can be an effective method of modeling this systematic risk but it fails to capture periods of 32 extreme risk. Further analysis can be done by trying different types of models such as Vine Copula that can better capture these extreme moments.

Conclusion

In conclusion, this project provided key insights in relation to system risk of the SPY. There was an overall rough inverse relationship between VaR and CoVaR. In general, sectors with higher individual risk possessed a lower systematic risk. More specifically, the Consumer Staples and Healthcare sectors possessed the lowest individual risk and highest systematic risk across financial crisis and COVID periods that were examined. On the other hand the Energy sector possessed a high level of individual risk and low level of systematic risk across both time periods. This indicates that the Consumer Staples and Healthcare sectors are the most resistant to market shocks and their movement have a high amount of impact on the overall market. The Energy sector is the most exposed to market shocks but its movement has a low impact on the overall market. Guassian Copula can be an effective method of modeling this systematic risk but it fails to capture periods of 32 extreme risk. Further analysis can be done by trying different types of models such as Vine Copula that can better capture these extreme moments.