Abstract

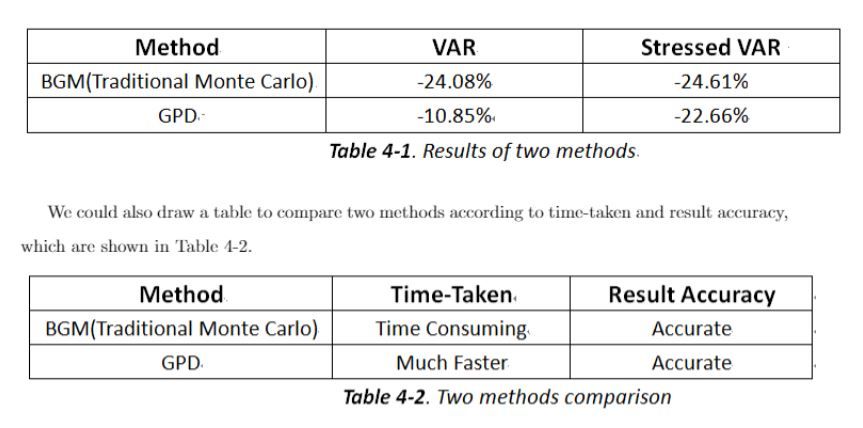

The main purpose of this study is to propose a new method in calculating market risk RWA (Risk-Weighted Assets). RWA is a bank's assets or off-balance-sheet exposures, weighted according to risk. Basel III is part of the Basel Committee's continuous effort to enhance banking regulatory framework. To calculate the risk measures of the Basel standard, banks usually use Monte Carlo simulation. However, MC simulation can be very time-consuming, and the commonly used risk measures like VaR and CVaR only deal with tails of a loss distribution. To address this issue, two methods are used to calculate RWA on a basket of US dollar plain vanilla interest rate swaps. First we use traditional Monte Carlo simulation for LIBOR Market Model (Brace, Gatarek, Musiela, 1997). Secondly, we use a power-law-type distribution -- generalized Pareto distribution in the extreme value theory domain. Then we compare the speed and accuracy of the results of these two methods.

Research Topics:

Monte Carlo Simulation, Basel III Market Risk RWA, Generalized Pareto Distribution, LIBOR Market Rate Model, VaR, CVaR

Researchers:

Research Group (2015 Spring):

Dezong Liu, Master in Financial Engineering, Graduated in May 2015

Zheng Yao, Master in Financial Engineering, Graduated in May 2015

Raj Bhalla, Master in Financial Engineering, Graduated in May 2015

Zhixiang Cao, Master in Financial Engineering, Graduated in May 2015

Advisor:

Dr. Rupak Chatterjee

Main Results:

Compared to the BGM model, the GPD model is at least 100 times faster and it successfully captures big losses.

Conclusions

Two methods are examined and compared in the study. We find that the GPD model performs much better in terms of the speed and the accuracy. Thus, we recommend practitioners to use power law type distributions for risk management.