Researchers

Jahnavi Ravi

Priyanshi Dholakiya

Saloni Kaur Bagga

Faculty Advisor

Prof. Khaldoun Khashanah

Abstract

This report presents a comparative study exploring the efficacy of human-driven trading methodologies against AI-powered approaches in portfolio management within the stock market. Beginning with a meticulous selection process, we curate 4 diversified portfolios of 5 stocks each (one by human, one by GPT 3.5, one by GPT 4 and one by AI performance metric analysis) across key sectors, employing a range of financial metrics to identify optimal candidates. Subsequently, we conduct a comprehensive evaluation of both human and AI trading portfolios, leveraging analytical techniques including adjusted closing price trends, sentiment analysis, and technical indicators such as Simple Moving Averages (SMA). Additionally, we delve into the development and performance analysis of AI-driven trading strategies, utilizing machine learning algorithms for autonomous decision-making. Through rigorous analysis and comparison against traditional benchmarks such as the SPY Index, we aim to elucidate the strengths and limitations of each approach. Employing a variety of programming languages and tools including R, Python, and Excel, our study provides valuable insights into the evolving landscape of financial analytics, shedding light on the symbiotic relationship between human expertise and machine intelligence in navigating the complexities of the financial markets.

Introduction

In today’s dynamic financial landscape, the intersection of artificial intelligence (AI) and traditional trading strategies has become increasingly prominent. This report delves into the realm of financial analytics, exploring the effectiveness of AI-driven trading strategies compared to human-centric approaches. Artificial Intelligence (AI) has been making significant strides in various domains, and the financial sector is no exception. The application of AI in trading, commonly known as AI trading, has garnered considerable attention due to its potential to revolutionize investment decision-making processes. Simultaneously, human trading and technical analysis remain crucial components of the financial landscape, each offering unique advantages and insights. AI trading leverages advanced algorithms and machine learning techniques to analyze vast amounts of data, identify patterns, and make informed trading decisions (Nti et al., 2020). By processing real-time market data, news, and sentiment analysis, AI systems can potentially identify lucrative trading opportunities more efficiently than human traders (Hiransha et al., 2018). Additionally, AI systems can execute trades with high speed and precision, minimizing the impact of human emotions and biases (Kou et al., 2021). However, human traders bring invaluable expertise, intuition, and experience to the trading process. They can interpret market dynamics, geopolitical events, and qualitative factors that may be challenging for AI systems to comprehend (Nti et al., 2020). Human traders can also adapt to changing market conditions and incorporate subjective judgments, which can be essential in navigating complex financial environments (Kou et al., 2021). Technical analysis, a widely used approach in financial markets, involves studying historical price and volume data to identify patterns and trends (Pring, 2014). It relies on the premise that market behavior is not entirely random and that past price movements can provide insights into future price movements (Murphy, 1999). Technical analysts use a variety of tools, such as chart patterns, indicators, and oscillators, to make trading decisions (Pring, 2014). The integration of AI trading, human trading, and technical analysis can potentially lead to synergistic benefits. AI systems can augment human decision-making by providing data-driven insights, while human traders can incorporate qualitative factors and intuition to refine trading strategies (Nti et al., 2020). Technical analysis can complement both AI and human trading by identifying potential entry and exit points and validating trading signals (Kou et al., 2021).

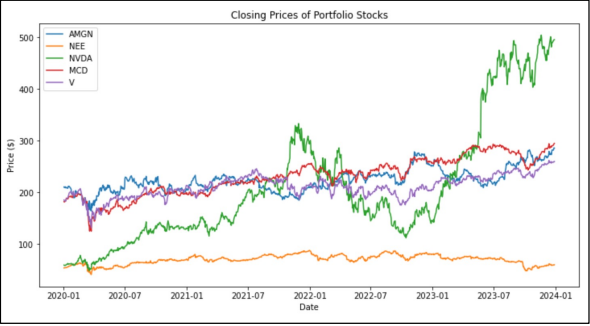

Data

The data used in this project consists of historical daily or weekly adjusted closing prices for five selected stocks over a suitable time period. The selected stocks come from five different sectors: Healthcare, Energy, Technology, Consumer Discretionary, and Financials. Historical data was downloaded, and log returns for each stock were computed. These log returns were then used to calculate annual returns, which formed the basis for further analysis using tools like the PerformanceAnalytics package in R. The data also includes various financial metrics such as price-to-earnings ratios, profit margins, revenue growth, beta values, and other performance indicators used to evaluate stock selection and portfolio risk analysis.

Summary

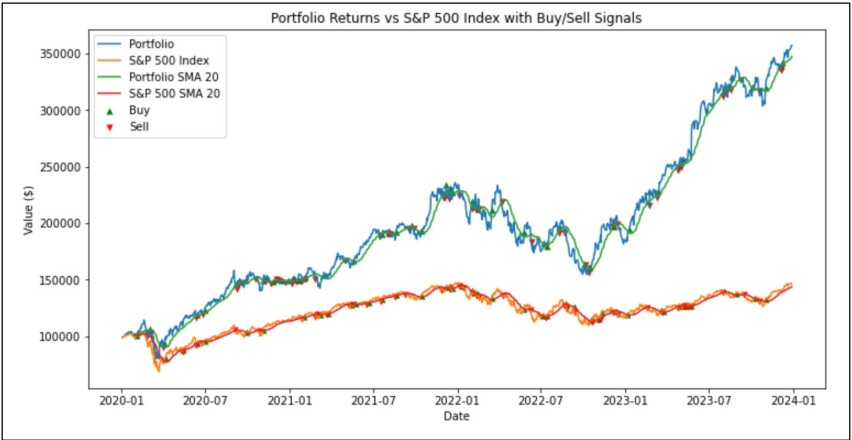

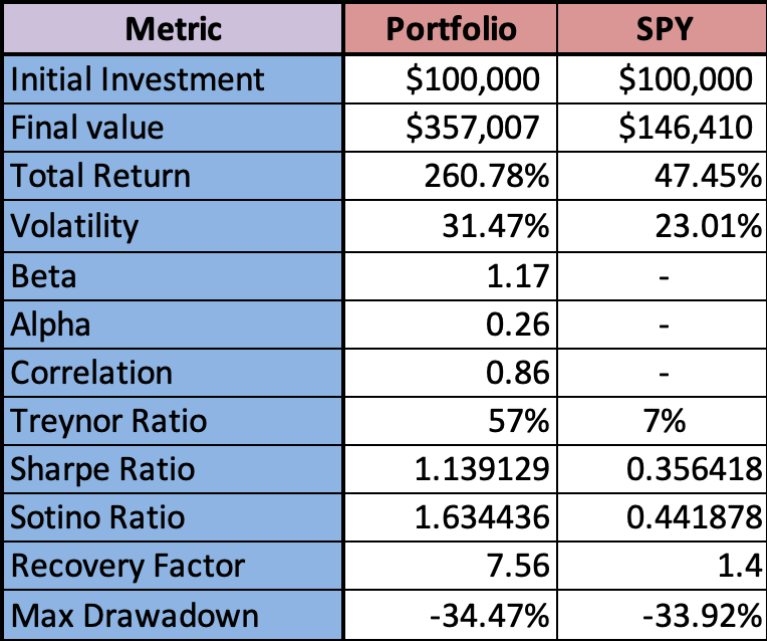

In an era where artificial intelligence is transforming financial markets, our study compares the effectiveness of human-driven trading strategies with AI-powered approaches in portfolio management. We curated four diversified portfolios of five stocks each, selected by human expertise, GPT-3.5, GPT-4, and an AI performance metric analysis. Using various financial metrics, we evaluated both human and AI trading strategies, employing techniques like Simple Moving Averages (SMA) for human trades and sentiment analysis for AI decisions.

Our research emphasized the development of AI-driven trading strategies using machine learning algorithms for autonomous decision-making. By comparing these approaches to traditional benchmarks like the SPY Index, and utilizing tools like R, Python, and Excel, the study highlights the strengths and limitations of both human and AI trading methods. It provides valuable insights into the evolving relationship between human expertise and AI in financial markets, shedding light on the future of portfolio management.

Conclusion

While AI excels at processing vast data, executing trades swiftly, and maintaining discipline, human traders contribute critical qualities like intuition, adaptability, judgment, and ethical considerations. Integrating AI algorithms with human oversight creates a powerful hybrid approach, combining AI's speed and precision with human insight. This synergy enables investors to better navigate markets, seize opportunities, and mitigate risks, leading to more robust and successful investment outcomes.